- Porter's Daily Journal

- Posts

- You Can Believe the Math

You Can Believe the Math

Porter's Journal Issue #25, Volume #1

Or You Can Believe the Politicians

Either Way, Inflation Is Going Much, Much Higher

Table of Contents

Three Things You Need To Know Now:

1. Is the “Trump Trade” unwinding? This morning, the financial media reported that both the U.S. dollar and U.S. Treasury yields were trading slightly lower following recent polls showing momentum shifting in favor of Vice President Kamala Harris, over former President Donald Trump. The dollar and yields had soared over the past several weeks, amidst rising expectations of higher inflation (and fewer Fed rate cuts) in a second Trump presidency. Trump holds a significant lead on all online betting sites, though it has narrowed from a peak of 64% versus 38% for Harris last week.

Does it matter who wins the election? In many ways… no. And before it’s too late – if you haven’t already – learn how you can protect your assets, and your portfolio, in this conversation I had with economist Peter St Onge... yes, we’re selling a product. But the presentation is full of great insight, including my #1 stock to get shelter from the market volatility that lies ahead.

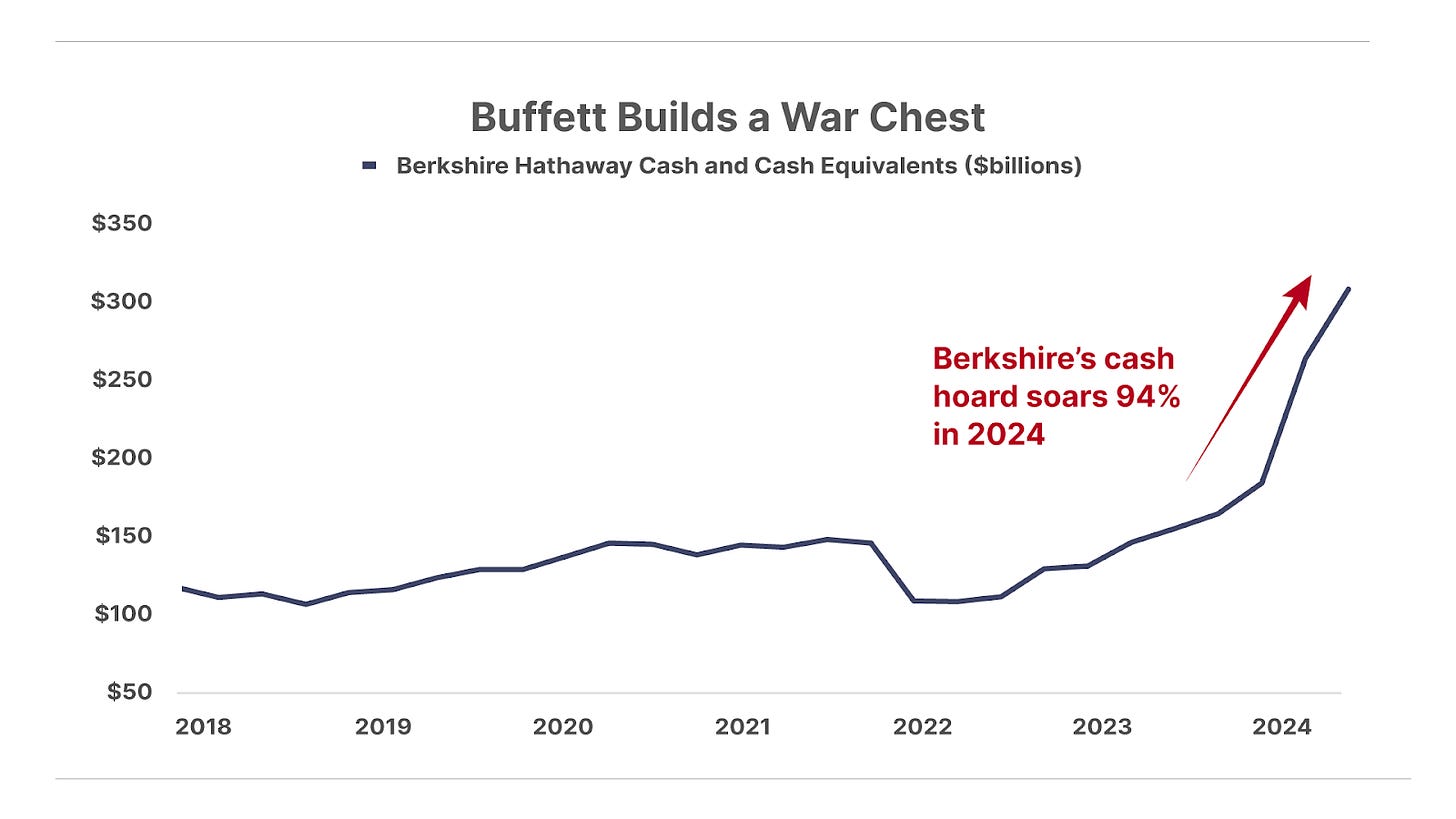

2. Buffett raises cash. According to Berkshire Hathaway’s Q3 financial report released over the weekend, Warren Buffett has continued a stock-selling spree that’s now gone on for eight consecutive quarters. Berkshire liquidated $34.6 billion from its stock portfolio in Q3, including offloading another 100 million (of its 400 million remaining) shares of Apple (AAPL). Berkshire’s cash balance has nearly doubled since the start of the year – and now accounts for a record-high 28% of its total assets. And he isn’t alone in selling (see below). Meanwhile, as we’ve explained recently, mom-and-pop investors are buying stocks like never before. Don’t say we didn’t warn you…

3. OPEC punts on a production increase. OPEC announced on Sunday that it is delaying its plan to begin to pump 2.2 million barrels per day (b/d) more oil into the market. The group of global oil producers originally planned to add 180,000 b/d of production in December, but has now pushed that back to January. In light of sluggish global demand and record-high U.S. production, OPEC is struggling over whether to give up market share through reduced production levels – or flood the market with excess supply. Despite the continued prospect of an expanded war in the Middle East, oil prices have been weak – falling 12% in the last year – suggesting underlying weakness in the global economy.

And one more thing…

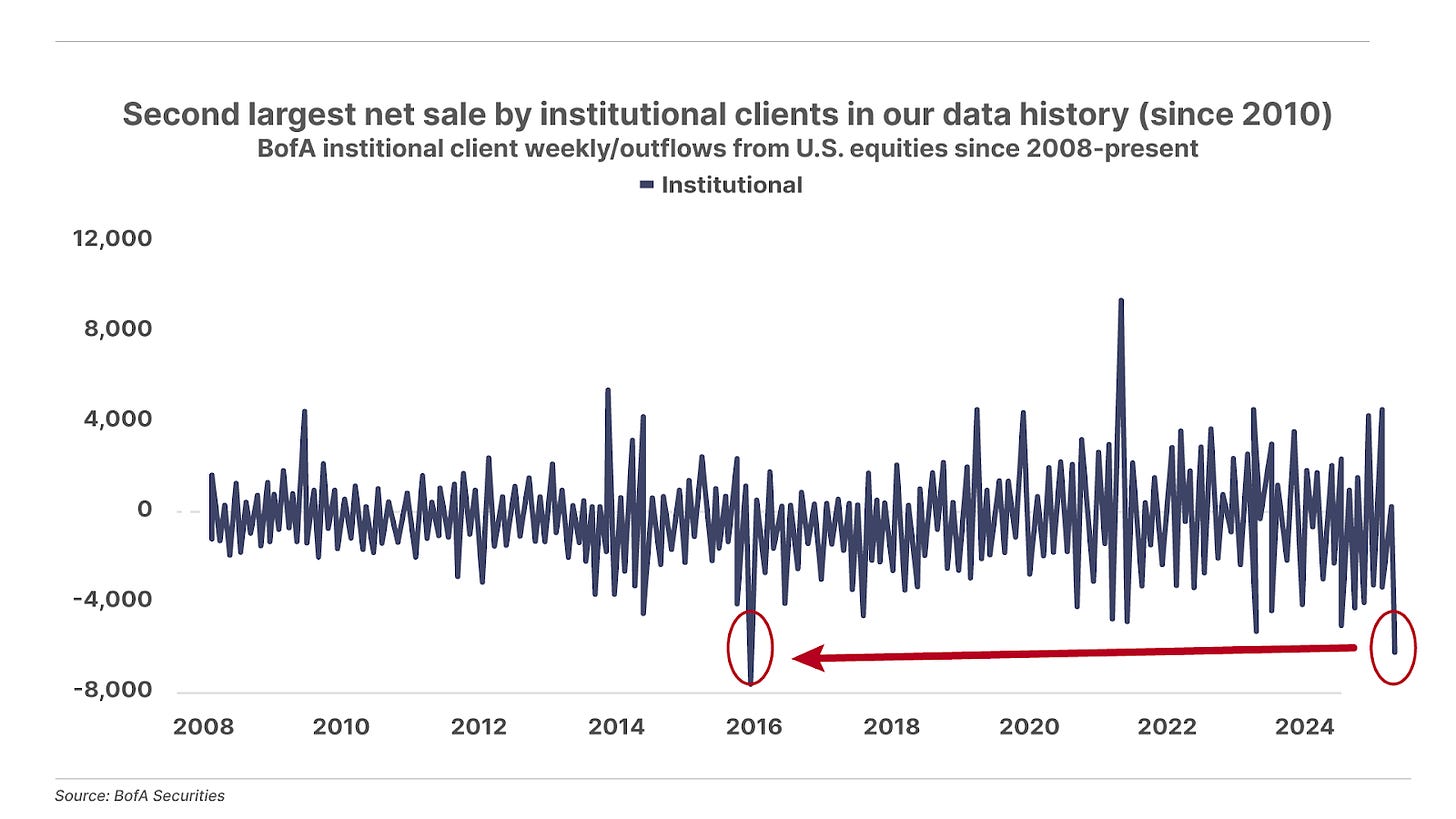

While retail investors are pouring into the stock market, where valuations are near all-time highs, the “smart money” – institutional investors – is running in the opposite direction. And it’s not only Warren Buffett… According to Bank of America’s report on institutional investing, the week ending October 25 registered $6 billion in outflows from the U.S. stock market. That’s the largest selling spree in eight years, and the second largest in the bank’s data going back to 2010:

You Can Believe the Math Or You Can Believe the Politicians

Either Way, Inflation Is Going Much, Much Higher

I’ve made a career out of believing what the numbers tell me, not what the media tells me.

And definitely not what the politicians tell me.

In 2006, I calculated that General Motors (GM) hadn’t been able to earn enough money making cars to afford the interest on its debt in 19 out of the previous 20 years. Obviously, when you can’t afford the interest on your debt, you’re going to go bankrupt eventually. Shorting GM was therefore a one-way bet. There was no way I could possibly be wrong.

That the company was also paying thousands of people to sit in company cafeterias all day (rather than laying them off) because of union rules made writing my “Letters From the Chairman of General Motors” in 2007 and 2008 even more entertaining.

People who do stupid things with capital and labor should be mocked. And they should fail. That’s how capitalism works.

In 2008, I made a similar, simple calculation about mortgages. I’d read another analyst making a case for buying shares of insurance giant AIG (AIG) and federally supported mortgage buyer Fannie Mae (FNMA). That didn’t seem wise to me, primarily because he was echoing the claims of then Fed Chairman Ben Bernanke, who said that the losses in subprime mortgages were “contained.” I made a very safe assumption that the Fed chairman was lying. And I checked his math.

Here’s exactly what I wrote to my subscribers in June 2008:

Today, on a combined basis, Freddie and Fannie own or guarantee 45% of all of the mortgages in the United States – $4.8 trillion worth of mortgages. But looking only at the mortgages they actually own and hold on their balance sheets, you find mortgages with a face value of $1.7 trillion. They hold these assets with only a sliver of equity, about $70 billion in "core" capital. On a combined basis, they're leveraged by a little more than 24-to-1. Thus, a 5% loss in the value of their mortgages would wipe out 100% of the equity in each firm. Looking beyond their balance sheets to their off-balance-sheet guarantees, you see that they're actually leveraged 68-to-1, meaning a 1.4% decline in the value of their total on- and off-balance-sheet would wipe out shareholders.

Nationally, the average price of a home has now fallen by more than 15%. The delinquency rate for all residential mortgages at the end of the first quarter of 2008 was 6.35% – a record high. In addition, the percentage of mortgages in foreclosure is now 2.47%, up almost 100% from last year. Adding the two numbers together, you see that nearly 9% of all of the mortgages in the United States are either in default or in foreclosure. The Census Bureau reports that about 10% of houses built after 2000 stand vacant. This is unprecedented.

I submit to you: Both stocks are certainly and clearly already zeros.

I went on to predict that the losses Fannie and Freddie would suffer would end up being at least $250 billion, which ended up being just about exactly right.

That the math was obvious and overwhelming didn’t stop the politicians from lying about it. A few weeks after I wrote that report, U.S. Treasury Secretary Henry Paulson testified before Congress that both Fannie and Freddie were “well capitalized.” Rarely has a bigger lie been told in that hall of liars.

Making this situation even more satisfying, Franklin Raines – a product of Harvard University and the poster-child of the liberals’ affirmative action and early DEI policies – ran Fannie Mae like a mob boss, spending more money on lobbying than any other business in America. He went so far as to build “outreach centers” in certain Democratic wards, and handed out credit according to political demands. He also led the country in fraudulent accounting – which was no small feat in the age of Enron. Fannie would later spend $100 million defending him from lawsuits that stretched on for almost a decade. He would eventually repay $24 million in compensation that he fraudulently awarded himself while at Fannie.

The full story of Wall Street’s first-generation DEI leaders has never been told. But, Raines, along with Stanley O’Neal at Merrill Lynch and Ken Chenault at American Express (AXP), very nearly destroyed the country’s banking system. All Havard educated. All Democrats. All awarded their jobs I suspect in no small part because of their race.

If you’re looking for a stock to short, start with companies practicing DEI.

Today, the most obvious financial bubble is in the sovereign obligations of the world’s leading democracies. The math isn’t hard to understand.

Looking at the U.S., we have debts that far exceed our ability to repay or even to manage.

Again, the math is simple and it’s not hard to understand. The United States currently owes $36 trillion. Those numbers are soaring higher and higher because of two easy-to-understand factors. First, virtually all of the Fed’s spending is both mandated by law (transfer payments) and is indexed to inflation. And second, as more of our debt is “rolling over” and must be refinanced, the real impact of printing so much money during COVID is hitting our banking system, resulting in vastly higher interest rates. It’s the soaring interest costs that are causing the bond market to collapse.

Again, the math isn’t hard.

This pie chart explains everything that matters about the U.S. federal budget. As you can see, direct transfers, transfer payments made through the states, and direct payments to employees, make up roughly 75% of all government spending.

That spending, by the way, comes to about $5 trillion a year. That’s twice as much money as the government collects in income taxes. And it’s equal to the entire federal revenue. After paying for all of these handouts, there’s nothing left – not a penny for interest, not a penny left for paying down debt.

These items have soared in cost as more and more people have become completely dependent on the government. A Wall Street Journal study found that in 2022, more than 53% of counties in America depended on federal handouts for more than 25% of their income. That’s up from just 1% of counties in 1970.

In most places, America is very much a socialist country. And, in most places, the only growth in employment is the government. In fact, 2023 saw the fastest rate of government employment growth since 1990 – 709,000 new government jobs across America.

The huge leap in these expenditures is a function of the welfare rolls growing, benefits expanding, and, most of all, the impact of the COVID money printing.

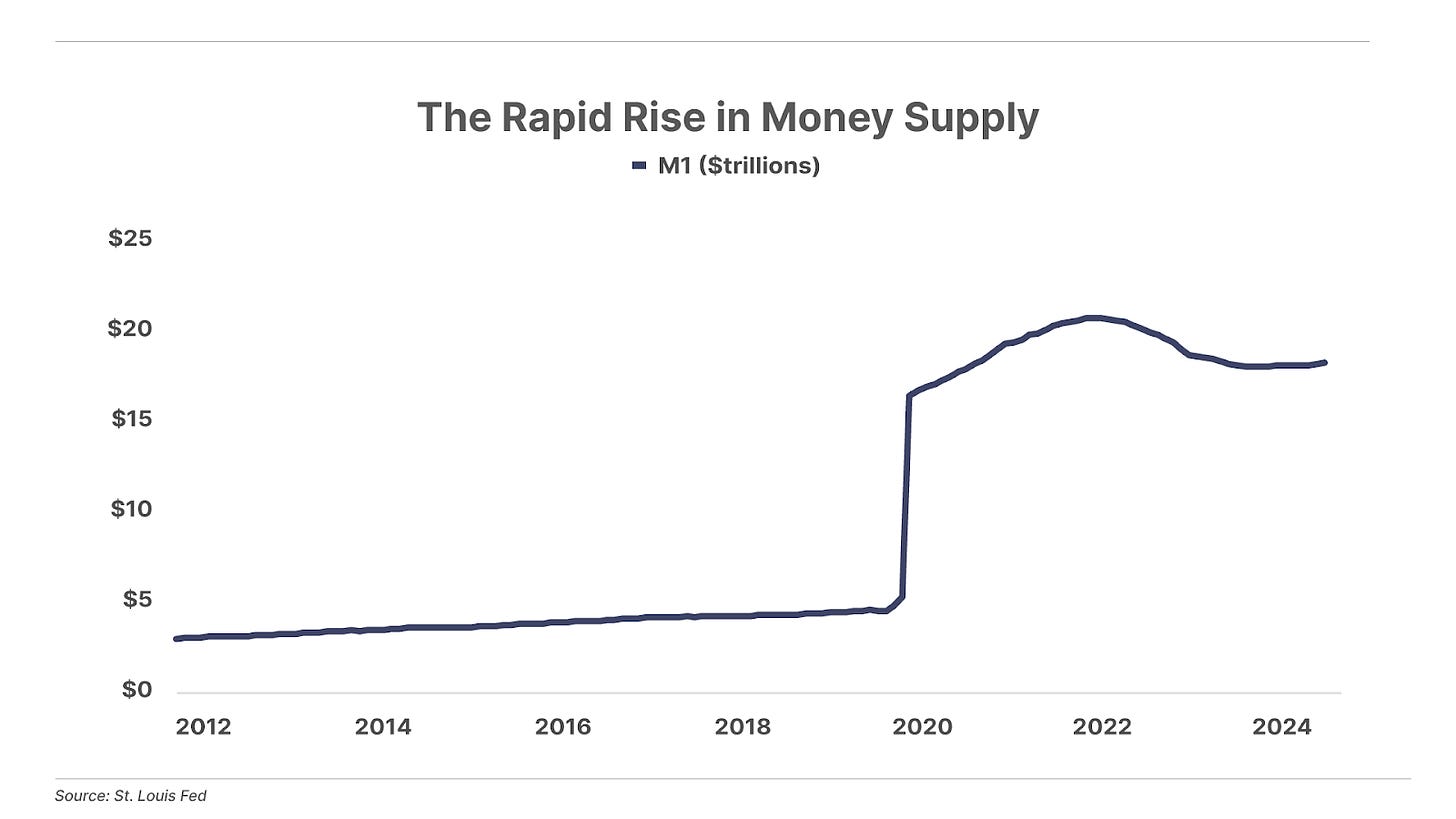

This chart shows the amount of money in circulation (M1 money supply). You can see the huge impact of printing trillions and trillions of dollars during 2020. The amount of dollars circulating in the banking system grew from $4 trillion to over $20 trillion in a two-year span. We will continue to see rising prices as a result.

And that will drive federal spending much higher because these transfer payments are indexed to inflation and because more inflation will cause the interest expenses to grow – a lot. As all of the low-cost bonds from COVID “rollover” they must be refinanced with higher-yielding debt to account for inflation. Bond investors expect to be paid.

Right now, most people believe that will cause the annual interest expense to increase to $1.6 trillion in 10 years. But I think that’s wishful thinking. The interest expense is already $1 trillion a year. And roughly half of the debt that’s held by the public (roughly $25 trillion) will need to be refinanced by the end of 2026.

Our interest expense is a function of how much inflation bond investors expect to see in the future. As those expectations rise, so will the government’s funding costs.

This a “doom loop,” where inflation causes both transfer payments and interest expenses to rise sharply. And efforts to contain the bond market by printing money and buying bonds will make the inflation worse.

And there’s one company that is sitting most squarely in the eye of this coming financial hurricane: Bank of America (BAC).

The bank’s CEO, Brian Moynihan, proves that you don’t have to go to Harvard or be a DEI hire to make really dumb decisions with other people’s money. Moynihan made the single worst investment in the history of the capital markets in the summer of 2020 when he bought more than $500 billion worth of “COVID bonds” – long-duration mortgages paying only about 1% a year.

As a result of this huge investment in low-yield (1%), high duration (15 years+) bonds, Bank of America can’t afford to offer its depositors interest on their deposits – making it very vulnerable to a run on the bank. That's why domestic depositors are only being paid 0.04% on deposits. And, even so, the bank’s yield spread (that is, the difference between what it earns on its money, and what it pays depositors) is still only 2.2%. So, if the bank offered even 1% on its deposits, its earnings would virtually disappear.

And, with inflation rising again (currently at 3.3%, stripping out food and energy), risks a run on its deposits unless it lifts its rates.

This is exactly what happened in the spring of 2023 to First Republic Bank and Signature Bank and Silicon Valley Bank, all of which owned similar bonds on their balance sheets that were very low-yielding and thus couldn't be sold without huge losses.

And that's the really scary part.

As long-term interest rates rise (they've moved from 3.6% a month ago to 4.4% today), the losses on Bank of America’s “COVID bonds” are mounting and most likely exceed $100 billion.

As rates go higher, the losses will grow and grow. At $200 billion, the losses on these bonds will bankrupt Bank of America.

Before that happens though, there will be a run on Bank of America.

That will lead to yet another national bailout of the banks. And that will drive inflation far, far higher.

It will also panic the stock market... which now sits at a record high.

You can believe the numbers. Or you can believe the liars on TV. Either way, the math wins in the end.

In Case You Missed It…

Last week in The Big Secret on Wall Street… we explained how new government spending under whoever is elected tomorrow – like all government spending – will ultimately be paid for either through direct taxation, or, more likely, the “secret tax” of inflation. This destroys the buying power of the middle class, and contributes to the very real impression in the general population that the government is illegitimate.

In The Daily Journal last week, we extracted an issue of Biotech Frontiers in which editor Erez Kalir addresses something even more important than money: the health issues that might curtail your lifespan, and how to tackle them.

Also in the Journal last Monday, we wrote: “Everyone has a plan until they get punched in the mouth,” said boxer Mike Tyson. Federal Reserve Chair Jerome Powell is getting a mouthful of knuckles right now, as the bond market hits back against the Fed’s plans to lower borrowing costs. We’ve seen this movie before, and it doesn’t end well.

And we also released Investment Chronicles, our 200-page monthly guide to the most important and interesting stories from the worlds of investing, finance, and economics… including plenty of additional data that shows how U.S. markets are at all-time extremes.

Tell me what you think: [email protected]

Good investing,

Porter Stansberry,

Stevenson, MD

P.S. With sky-high uncertainty – U.S. elections, interest rates, the state of the U.S. and global economy, war in the Middle East – investors globally are concerned about how to position your portfolio. That anxiety is reflected in the recent rally in gold. Gold, of course, is an investment safe haven, portfolio insurance, a way to hedge against the decline of the U.S. dollar, and a compelling investment in its own right.

Meanwhile, the shares of gold mining companies have been seriously lagging: As we wrote in a recent Big Secret on Wall Street, the shares of gold mining companies are dramatically trailing the price of gold. A widely watched index of gold mining stocks hit an all-time high in 2011. Today – although the price of gold is more than double what it was in 2011, and sitting close to an all-time high – the gold mining stock index is about half the level as it was back then.

That anomaly won’t last. Mean reversion will kick in, and the shares of gold mining companies will soar. Which ones?

I’m not a gold analyst. Fortunately, I’m friends with Marin Katusa, who is one of the best in the gold business. He and I recently sat down for a wide-ranging conversation about gold and where it’s going… and the best ways to invest in gold today. You can watch it here.