- Porter's Daily Journal

- Posts

- Trump Versus Reality

Trump Versus Reality

Porter's Journal Issue #31, Volume #1

His Distortion Field Is Blinding His Supporters

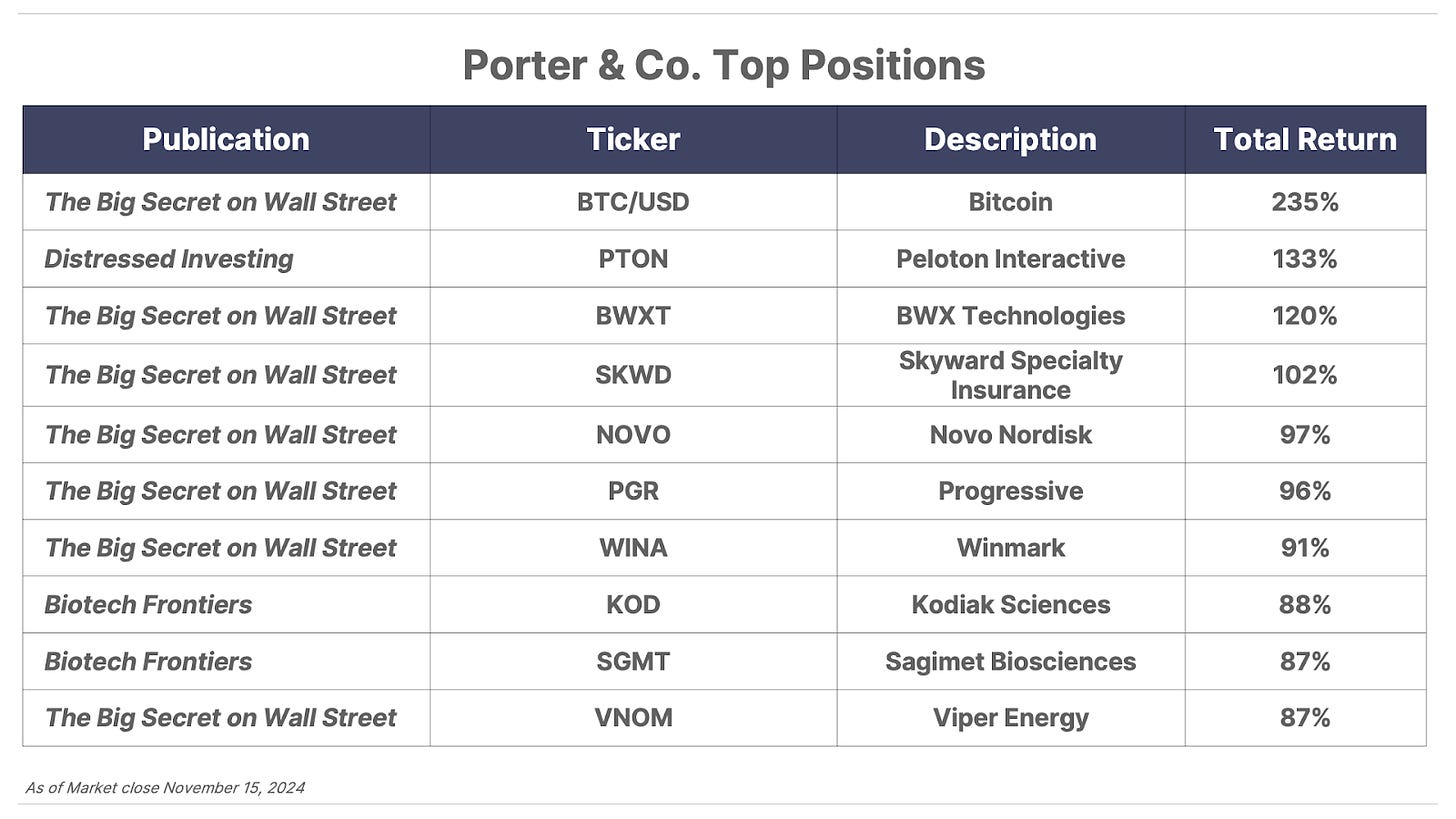

This is Porter & Co.'s free daily e-letter. Paid-up members can access their subscriber materials, including our latest recommendations and our “3 Best Buys” for our different portfolios, by going here.

Table of Contents

Three Things You Need To Know Now:

1. Coming this week: Nvidia (NVDA) earnings. The chip giant’s Wednesday evening release of third-quarter results will likely be far more important to the market than the seven (!) speaking events by different Federal Reserve governors scheduled for this week. As ever, what matters far more than what Nvidia already did is what it says it will do in coming quarters… Any indication of a slowdown in artificial intelligence (“AI”) spending will hit markets hard.

If you’re not clear about what the fuss over Nvidia is all about… it’s at the forefront of what may well be the biggest technological innovation in human history. And if you think it’s only about AI, you’re seeing only a small bit of the picture. Porter put together a video to explain the parallel-processing revolution – in a way that even (especially!) non-tech people can understand. It’s well worth a watch.

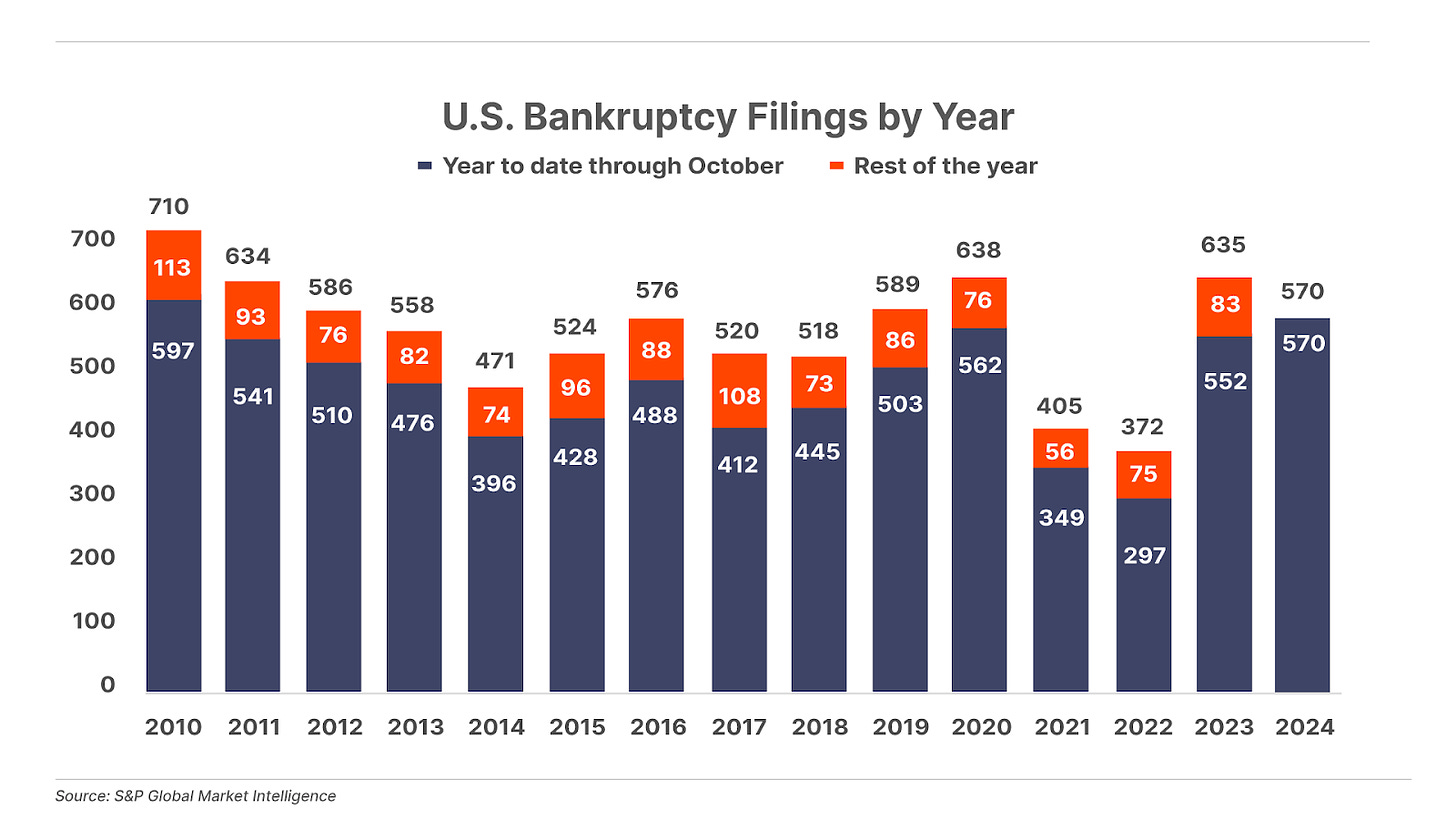

2. Bankruptcies hit their highest levels since 2010. Through the end of October, a total of 570 large U.S. corporations have filed for bankruptcy in 2024, the highest year-to-date number since the immediate aftermath of the Global Financial Crisis. Despite the rising number of bankruptcies, reflecting companies’ difficulties with paying their debt, spreads on high-yield bonds versus Treasuries remain historically low at 4% – their tightest levels since 2007. The last time the high-yield spread was this low – reflecting extreme optimism on the part of investors – was right before a massive financial crisis.

Worth noting… escalating bankruptcies aren’t just an American phenomenon. In the first half of the year, 74 companies in Japan filed for bankruptcy – the highest number since 2000. In Germany and France, the number of bankruptcies is significantly higher compared to last year as well. Hold on tight.

3. TINA is dead. Since the Global Financial Crisis, TINA – the idea that “there is no alternative” to stocks – has ruled markets. The Federal Reserve’s drastic actions following the Global Financial Crisis helped drive bond yields far below the earnings yield of equities (calculated by dividing the market’s earnings by its price – that is, the inverse of the price-to-earnings ratio). This made stocks relatively more attractive than bonds. But, for the first time in 22 years, that is no longer the case… Today, investors can earn a higher yield in 10-year Treasury notes (4.40%) than they can in the S&P 500 (3.60%). Historically, this suggests the equity market is overvalued – and is another bad omen for stocks.

And one more thing…

Shorting stocks (that is, betting that they’ll decline) is usually a fool’s game. After all, markets tend to rise, so you’re fighting the tide by banking on a stock falling. You can lose everything by shorting a stock. And shorting isn’t cheap, either.

Nevertheless, last week, we recommended shorting a stock, for the first time ever at Porter & Co. Why? Even though, on average, shorting stocks doesn’t pay off, the odds improve during a bear market. That’s because of what’s known as crisis alpha, or the ability to generate profits when everything else in a portfolio is falling in value. Then those profits can then be directed into stocks that are trading at deeply discounted prices, setting the stage for massive long-term wealth creation.

Most Daily Journal readers, though, stay away from shorting… nearly two-thirds of people who responded to our poll last week say that they’ve never shorted a stock. (Maybe that will change with our second-ever short recommendation… stay tuned for the next issue of The Big Secret on Wall Street on Thursday.)

Trump Versus Reality His Distortion Field Is Blinding His Supporters

Steve Jobs was famous for having what one of his colleagues called a “reality distortion field.”

His ability to manifest results at Apple (AAPL), especially in product development, was based on getting people around him to believe they could build things that had never been built before – in a matter of days, not years. (If you don’t know the story, the development of Gorilla Glass is a perfect example of Jobs’ reality distortion field at work.)

I met former President Donald Trump at Mar-a-Lago, his club in Palm Beach, last March.

I believe he has a similar reality distortion field. He knows that America’s economy, and our society, have been warped by progressive politics, and he believes (correctly) in the American people. Restoring our property rights (by reducing regulatory burdens) and slashing the cost of the government will allow America to grow out of its debt burdens and restore a broad prosperity to the middle class.

Trump’s reality distortion field, however, is blinding his supporters into thinking that this will happen without major dislocations in the markets.

And, unfortunately, decades of woeful financial management have left our country more at risk than ever before to an enormous debt-fueled economic collapse – witness (in point 2 above) the huge rise in bankruptcies this year.

Most at risk?

The U.S. consumer. Credit card debt is up 214% from $350 billion in 2008, to a record high $1.1 trillion today. Auto loans are up 100% from $800 billion in 2008, to a record high $1.6 trillion today. Student loans are up 200% from $600 billion in 2008, to a record high $1.8 trillion today.

As employment declines (we’ve seen nine straight months of declining employment) and consumer debt defaults mount, there’s a rising likelihood of massive consumer debt default. And, as Trump moves to cut government spending and steps up efforts to collect on student loans, there will be a big decline in discretionary spending.

And, in fact, that’s already begun.

How do I know? The restaurant sector is on track to post the highest number of bankruptcies in decades (not including the pandemic-induced shutdowns in 2020).

In Miami Beach last weekend, I was able to walk into Prime 112 without a reservation at 7 pm on Saturday night. The restaurant was only half full. By 10 pm, it was empty. For the past 20 years, Prime 112 has been the highest-grossing restaurant in the country, per square foot. And… for the first time ever… the restaurant group had to close down one of its other Miami Beach eateries. The key culprit is rising inflation hitting consumer wallets and higher operating costs squeezing restaurant owners.

The Wall Street Journal reports: “More eateries on the edge are likely to file for bankruptcy in the coming year, according to restaurant executives, attorneys, and lenders.”

Trump’s move to cut government spending will also impact a lot of big businesses.

That’s important and will bring economic benefits over the long run. But, for today, it means we’re facing huge economic risks: U.S. corporations have never borrowed more money, ever before, as a percentage of GDP.

All of this debt has led to a big decrease in corporate credit quality.

Currently there’s a huge wave of investment-grade bonds ($60 billion in total) that are trading just one notch above junk status. When they’re downgraded to junk, this will trigger a huge decline in corporate bonds because most bond and pension funds aren’t allowed to own non-investment-grade (“IG”) corporate debt.

One big culprit: Boeing (BA).

“It’s kind of this slow-moving car wreck,” said Hunter Hayes, chief investment officer at Intrepid Capital Management. “Obviously, some of these bigger, on-the-cusp, IG names have had some issues – Boeing being the poster child. But there are a handful of them, and what’s interesting about it to us is just the size.”

When Boeing is cut to below investment grade, that will kick off the next big corporate default cycle.

When that happens, it won’t be a good week for the stock market. (What happens to Boeing shares? They’re a great short, as we explained last week.)

But it will set up a once-in-a-decade opportunity to buy high yielding, “money good” corporate bonds with yields-to-maturities between 20% and 30%.

These corporate credit cycles are a wise investor’s path to prosperity. And, fortunately for Porter & Co. subscribers, the world’s best high-yield analyst, Martin Fridson, runs our Distressed Investing research team. (To learn more about what Marty and his team are doing – and about how the unfolding economic environment will be the best in decades for distressed investing – see what I had to say here.)

Stick around. We’ll show you how to turn Trump’s distortion field into reality.

As always share your thoughts on this topic with me directly: [email protected]

Good investing,

Porter Stansberry,

Stevenson, MD

P.S. Steve Jobs is no longer with us… and Apple, at a P/E multiple of 34 (and total revenue growth over the past years of an anemic 7%) isn’t where you want to put too many of your tech investment dollars.

A far better bet: Listen to what my friend and former colleague Jeff Brown thinks about the best places to invest in tech.

Years before others saw what was coming, Jeff was recommending tech investments like Bitcoin (up ~27,000%), Nvidia (up ~11,000%), and AMD (up ~1,200%+), among many others.

Jeff’s ability to see the future of technology has been up there with the greatest of all time. His research is followed by hundreds of thousands of readers, from individual investors and institutional hedge funds to tech leaders and investment analysts – and of course, me too.

Last week, Jeff shared with Porter & Co. readers a report – that’s normally available only to his paying subscribers – about a company that could potentially save millions of lives by ending human diseases caused by genetic mutations. Wall Street, though, hasn’t yet caught on.

Subscribers to Jeff’s research have access to his extraordinary insight. If you want more from Jeff – including his full portfolio – you can go here. Jeff’s team has set up a special invitation only for Porter & Co. that gets you his best work at a fraction of the prices others pay.