- Porter's Daily Journal

- Posts

- The Best Real-World Measure of Wealth

The Best Real-World Measure of Wealth

Porter's Journal Issue #26, Volume #1

Hint: It Ain’t GDP Or a Booming Stock Market

This is Porter & Co.'s free daily e-letter. Paid-up members can access their subscriber materials, including our latest recommendations and our “3 Best Buys” for our different portfolios, by going here.

Table of Contents

Three Things You Need To Know Now:

1. Trump wins. Now what? We expect a top-to-bottom restructuring of how the federal government operates, including a rollback of climate-related regulations, lower taxes, and a sharp retreat of the U.S. from the global stage. We think the most important and most likely economic outcome of a Trump presidency is a massive buildout of energy infrastructure – see our essay below. What’s sure to happen in the short term is higher interest rates in the bond market, because of fears of much larger deficits, and a stronger dollar, as Trump competes more effectively on trade.

2. The market loves Trump. The big “gap” open in the stock market this morning was only the third gap up of more than 1% the morning after an election since the inception of S&P 500 futures trading. The other times this has happened (in 2004 and 2020) were both indications of powerful market rallies. (Hat tip: Jason Goepfert at SentimenTrader.)

3. A new railroad? In a Wall Street Journal op-ed yesterday, BlackRock CEO Larry Fink says America is on the verge of an infrastructure build-out on par with the transcontinental railroad. “The New Railroad” is how I described the original build-out of the internet, back in 1999, when I launched my first financial-newsletter business. (How many of our paid-up subscribers remember Pirate Investor? Let us know in the mailbag – please!) Morgan Stanley agrees, predicting $300 billion (!) in capex related to computer centers in 2025 designed to provide artificial-intelligence (“AI”) services. Amazon and Microsoft are expected to spend almost $100 billion each over the next decade.

If you’re a paid-up subscriber to The Big Secret on Wall Street (or a Partner Pass member) and haven’t yet, please, stop whatever else you’re doing and read our “Parallel Processing Revolution” report. It could easily be the most valuable information you ever receive… it’s here. If you’re not (yet) a subscriber, I urge you to watch this to understand more about what I’m talking about.

And one more thing…

The Federal Reserve is scheduled to announce its latest monetary policy decision tomorrow at 2 pm ET. And last night’s election results have suddenly made the central bank’s “job” far more difficult. Trump’s victory has already pushed growth and inflation expectations much higher. If the Fed continues to cut interest rates as planned, it risks setting off another inflationary spiral. Yet, if the Fed were to unexpectedly (the market is currently pricing in a 98.5% chance of a 25 basis point cut) end or suspend its rate-cutting cycle, it would likely be seen by Trump and the incoming administration as political interference. Chair Jerome Powell is in a no-win situation.

And also…

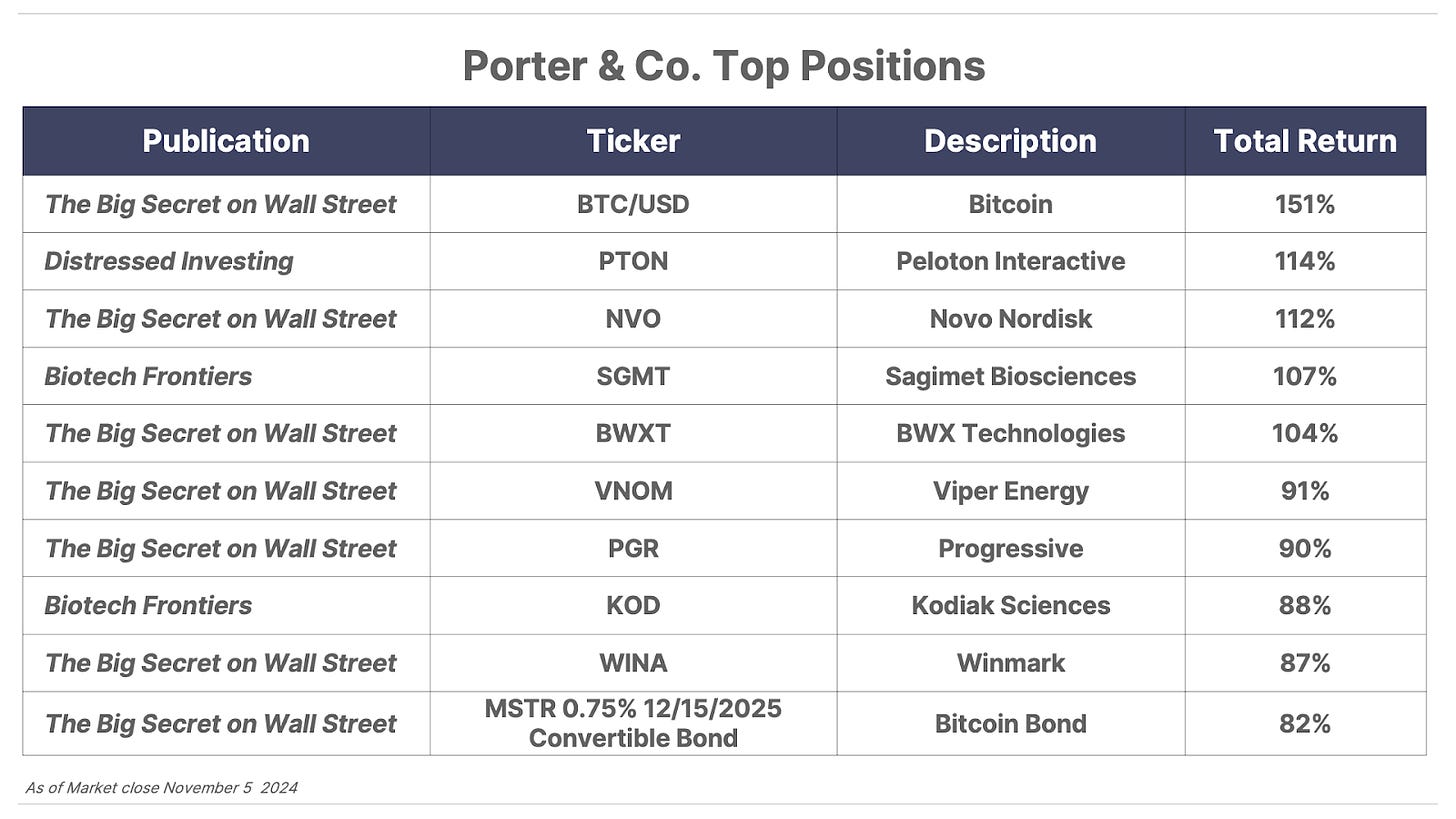

I’d like to thank and congratulate our research teams at Porter & Co.

The amount of work and the quality of the research that we’ve put out in advance of this election exceeds every reasonable subscriber expectation. Look at the results from our half-dozen Parallel Processing Revolution stocks, which we recommended in September: gains of 28%, 23%, and 17%. Put these gains together with the massive 30%+ gains we’ve seen in our most recent Texas oil field recommendation (September 25) and the incredible digging we did to find the best small property and casualty (P&C) insurance company in the world – up 13% in just two weeks.

You’ve seen us produce a stretch of equity research that rivals the performance of the world’s very best investors.

And then look at what Marty Fridson and his team have done for our Distressed Investing subscribers recently: a huge 50%+ gain on Peloton Interactive (PTON)! That’s one of two stocks he’s recommended this year (the other is also up more than 50%!) – in addition to the fantastic performance of the distressed bond portfolio. Marty has hit it out of the park.

And… as good as all of this has been… it simply doesn’t compare to the results that Erez Kalir has delivered at Biotech Frontiers. Erez’s second Sagimet Biosciences (SGMT) recommendation has already more than doubled, marking the second time this year he’s booked more than 100% gains – in the same stock! In my entire career, I haven’t ever seen so much value created in one portfolio, ever before – and with virtually zero downside volatility.

I recognize this short stretch of outstanding performance isn’t the final verdict on our work, but I hope all of our subscribers will recognize the extraordinary achievements of our team over the last three months. I’ve never seen any team of analysts, anywhere, produce better work.

Our Partner Pass membership ($10,000 initiation fee) is, without question, the best value when it comes to investment excellence.

Nobody is delivering more value to investors, anywhere in the world. If you want to completely change your investment performance, join our Partner Pass membership today and get access to the world’s highest-quality investment research. There’s no substitute for the best.

Please… if you’ve benefited from our work, let the team know how it’s impacted your portfolio. We truly care. And we love working for you.

And if you’re not one already, to become a Partner Pass member… Lance James, our Director of Customer Care, and his team are ready to walk you through the details, at 888-610-8895, internationally at +1 443-815-4447, or via email: support@porterandcompanyresearch.com.

Our poll for today…

If you answered “gold” – or even if you didn’t… gold should be a foundation of every portfolio. I recently sat down with one of the world’s premier experts on gold, Marin Katusa, to discuss this… you can listen to our conversation – and also learn how to take advantage of the continued bull market in gold – by going here.

The Best Real-World Measure of Wealth… Electricity

I want to tell you about the most important thing to watch during Trump's presidency. It's not what you're probably thinking, but it's the single best indicator of whether or not he's doing a good job and getting our country back on the right track.

First though, a quick word about the election.

I had been predicting publicly and privately a massive Trump victory, a "landslide," for one simple reason – because the Democrats found a way to infuriate and radicalize an entire group of Americans who don't normally think about government at all.

For me, the surest moment was when my sixth grader came home from school with a Martin Luther King Jr. Day movie list... that was missing the titles of every film the school planned to show our children. What was the school trying to hide? Each of the dozen or so films was woefully inappropriate, rated-R movies with explicit sexual scenes – for example, Brokeback Mountain, which is about a romantic relationship between two cowboys. And none of them had anything to do with improving race relations. They were all, in one form or another, propaganda for alternative lifestyles and, in some cases, virulently racist.

This was not an honest effort to broaden perspectives and educate our children: this was brazen indoctrination.

These kinds of things – constantly putting ideology ahead of competency – simply annoyed most Americans, including those of us generally in favor of liberal social standards.

Did we tire of the President's press secretary because she was the first homosexual woman of color to hold the position? Of course not. We tired of her because she couldn't speak in full sentences and she lied to us, brazenly, about the President’s failing health.

Did we object to the Secretary of Defense because he was a black man? Of course not. We objected to him because he went AWOL and seemed completely unable to meet the reasonable demands of a very challenging job.

Did we hate the President because his son Hunter Biden is a deeply troubled person? No. We have demons, too. But we don’t like the idea of people doing cocaine in the White House. We don’t like being lied to by every leading spook in the government. And we really don’t like the idea that our President is for sale to foreign powers.

I don’t think Americans have ever seen an administration that was less competent or more ideologically driven. What Americans want is a country that’s focused on merit and that appoints people to positions of authority who have real talent and experience. We want more competency. And a lot less ideology.

Hopefully, that’s what Donald Trump delivers.

Now, how will we judge the job he does for our country? Let me show you an incredibly accurate way to judge the relative success of our country that’s completely objective and non-political.

Constant inflation makes it difficult to measure how well (or how poorly) our economy is functioning.

Example: house prices are way up over the last decade. Is that good? In some ways, sure. But when most young adults can't possibly afford to buy a house, it's hard to say the economy is functioning well.

That's why if you want to understand the real economy (not just the financial markets), you must study real-world production statistics. If you don't, it can be very difficult to discern nominal changes (due to inflation) and real increases in wealth.

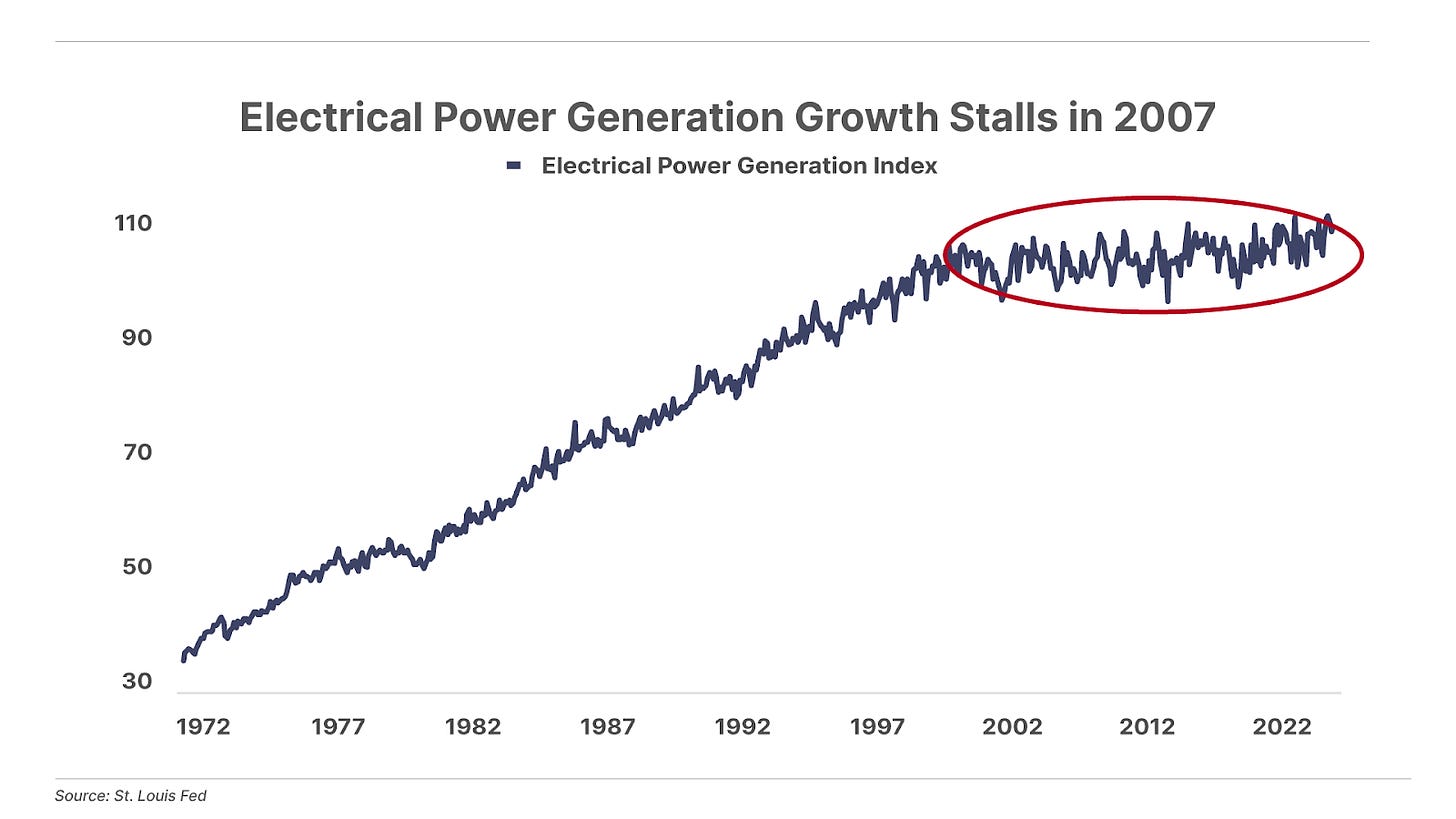

The very best real-world measure of wealth is electrical production. Tell me per-capita electrical production, and I'll tell you how rich a country is and how well its economy functions.

In the chart below, you can see that, for decades, electrical-power generation grew at a steady pace in the U.S. Right up until the end of 2007, when the Global Financial Crisis began.

The decisions we made back then (and have continued to make since) to "paper over" big problems in our economy, including continually bailing out so many huge companies (General Electric (GE), Citigroup (C), AIG (AIG), and probably Boeing (BA)) has seen prices explode and debts increase massively, but these cosmetic changes have only made moral hazard worse and have seen politics dominate our economy.

Our economy has become more financialized, with the government printing more and more money and playing an ever larger role in our economy. The result has been more debt and higher prices. But almost no further growth in electrical production.

The real-world reality is, our economy has been stagnant for almost 20 years. If we want to grow again, we must stop printing money, we must allow banks (and other large corporations) to fail, and we must massively reduce the size of our government.

And we must start producing more electricity.

Good investing,

Porter Stansberry,

Stevenson, MD

P.S. During the last Trump administration, tech shares boomed… the Nasdaq 100 index was up 173.7% (vs an 83.2% rise in the S&P 500).

That may or may not have had anything to do with government policies or incentives.

But it would be silly to sleep on the potential for technology shares to boom during Trump II.

And the man best positioned to help you is my friend Jeff Brown at Brownstone Research. He’s one of the best stock pickers I’ve ever worked with: He recommended Bitcoin in 2015 (up nearly 27,000%), Nvidia in 2016 (up almost 11,000%), and AMD in 2017 (+1,200%+).

What’s more… he has an uncanny ability to tell the future about the direction that technology is moving in, and who will be the winners.

In last week’s Porter & Co. Spotlight, Jeff shared his report – usually available only to subscribers – on a company he says “could become the market’s next AI darling.”

To find out more about Jeff’s research (at a substantial discount to his normal prices) and get his future recommendations, go here now.