- Porter's Daily Journal

- Posts

- Surviving Financial Repression

Surviving Financial Repression

Porter's Journal Issue #27, Volume #1

Get The Money First, Borrow At Fixed Rates

This is Porter & Co.'s free daily e-letter. Paid-up members can access their subscriber materials, including our latest recommendations and our “3 Best Buys” for our different portfolios, by going here.

Table of Contents

Three Things You Need To Know Now:

1. The Fed cuts. As expected, yesterday the Federal Reserve cut rates by 25 basis points, in its second rate cut this year, to 4.5%-4.75%. Markets are now pricing in substantial additional rate cuts – to the 4% level by March 2025. Absent massive growth in government spending (and deficits) the U.S. economy is in a recession. We expect lower short-term interest rates and much higher yields on bonds.

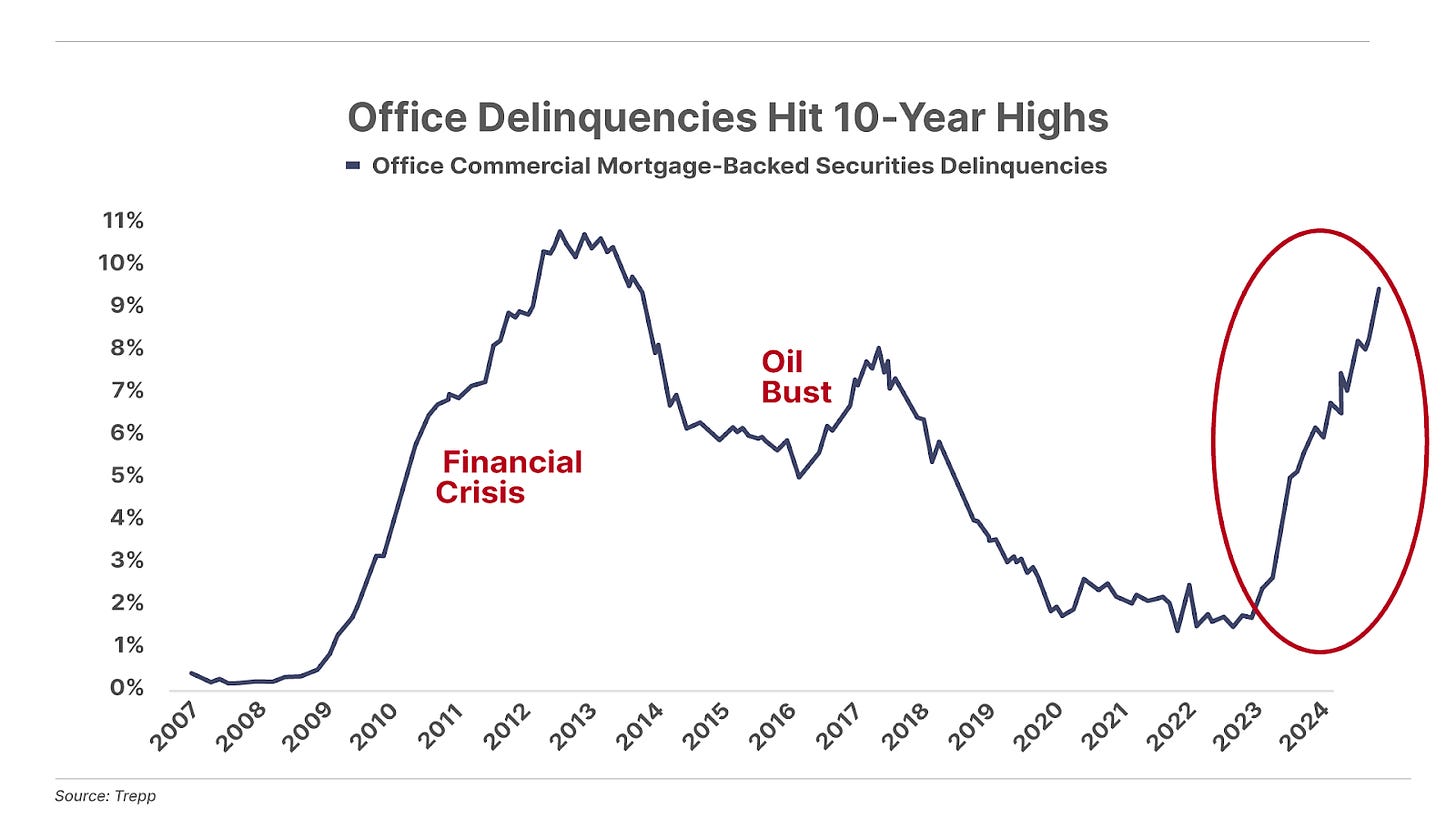

2. Office delinquencies near financial-crisis levels. Delinquency rates in commercial-office real estate hit 9.4% in October, double the level from a year ago, and the highest since the meltdown that followed the Global Financial Crisis. This is going to be a major problem for regional banks. Prices on office towers are plunging by 70% or more, with many deals closing at land value only prices, valuing the buildings at zero. The holders of these mortgages – the banks – face massive losses.

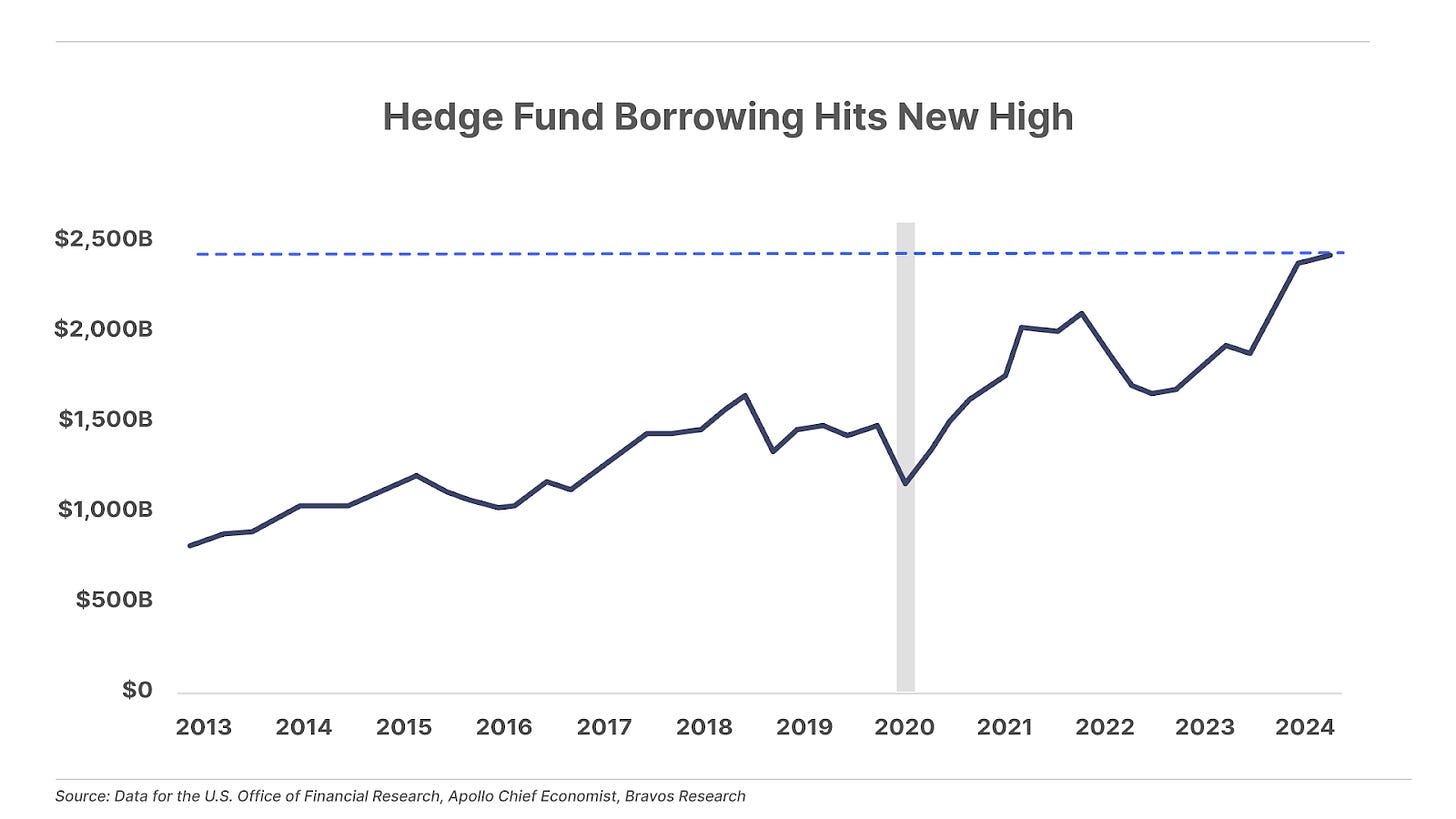

3. Signs of a top: hedge funds’ borrowing hits new high. Total prime brokerage borrowing by hedge funds hit $2.5 trillion, a record high. With the prime rate at 8% and stocks at all-time high levels, the so-called smart money is about to learn a painful lesson. Fellas, you’re supposed to buy low and sell high, not the other way ‘round.

And one more thing…

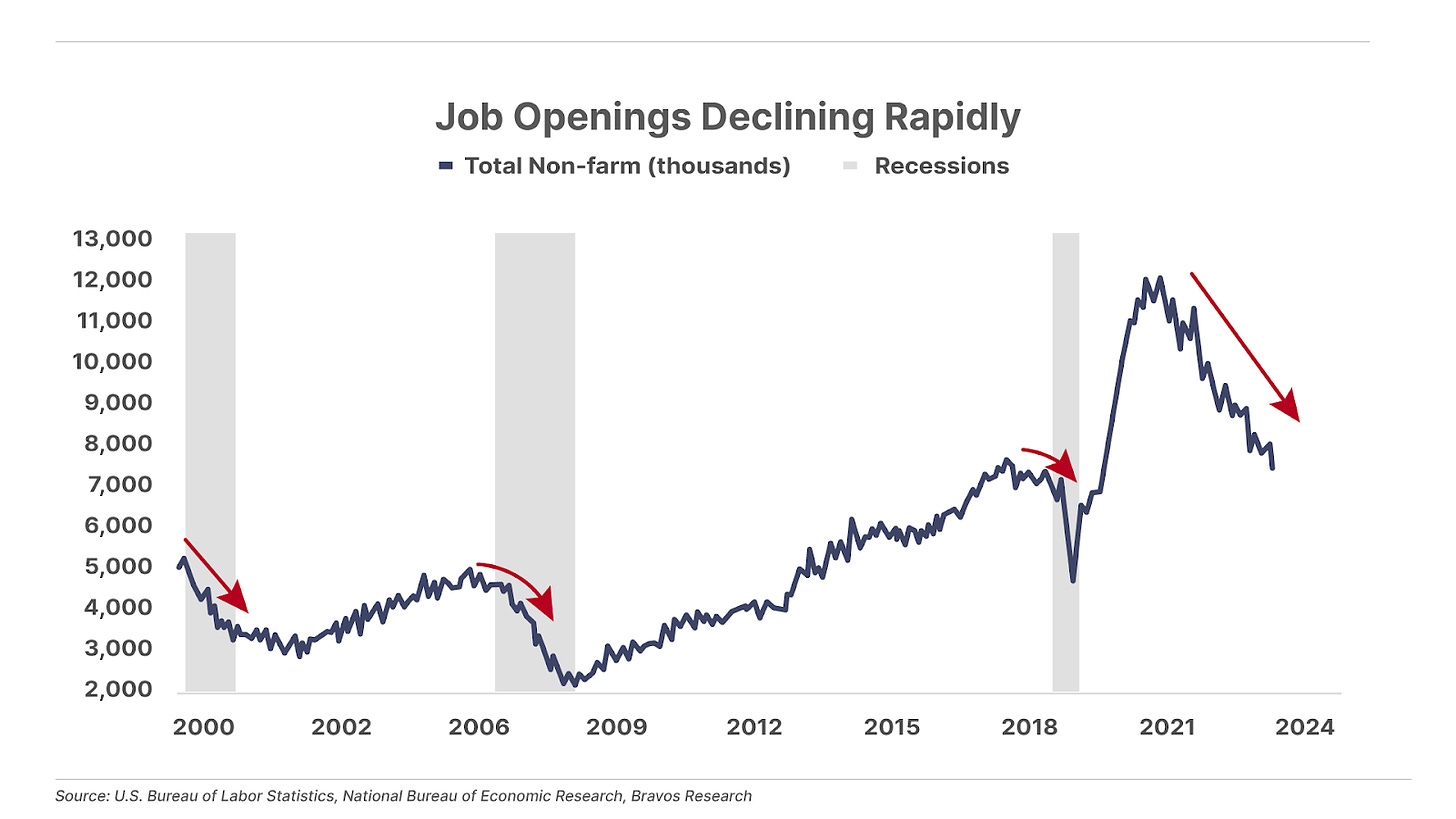

As we’ve been warning about for months, in the real economy (aka, not the government sector) layoffs are soaring. There’s no more sure sign of an impending recession. Job openings are now down 39% from March 2022. There’s no question absent the $3 trillion (!) deficit spending this year, the U.S. economy would be in a deep recession. How will Trump manage to contain inflation without triggering a recession? He won’t. He’ll drive inflation higher.

In Case You Missed It…

The latest episode of the Black Label Podcast dropped at 4 pm ET today. We interviewed very special guest Marko Papic – Chief Strategist of BCA Research… the essential source of macroeconomic research. Listen now, here.

Earlier in the week, we also released…

Thursday’s portfolio update for The Big Secret addresses a few top performers and reveals why – despite the wave of enthusiasm sweeping through the markets following Trump’s electoral victory – back on the earnings front, there’s reason for caution.

Erez Kalir’s latest Biotech Frontiers recommendation. “Magic bullets” for curing cancer exist today, and they go by the name of antibody-drug conjugates (“ADC”). In the past few years, ADCs have emerged as one of the hottest areas of cancer medicine… and of biotech deal making. Erez's focus this month is on an ADC trailblazer with a fortress balance sheet.

Finally, if you haven’t watched my new documentary about the multitrillion-dollar Parallel Processing Revolution, The Final Frontier, you should. Though this video was created to sell a product (Big Secret subscribers and Partner Pass members have access of course), I guarantee that you’ll find it interesting (and learn some new things).

As always, if you’d like to subscribe to The Big Secret, or to Biotech Frontiers – or have questions about any of our publications – just call Lance James, our Director of Customer Care, at 888-610-8895, or internationally at +1 443-815-4447.

Surviving Financial Repression: Get The Money First, Borrow At Fixed Rates

Richard Cantillon isn’t famous enough.

Every American should know his name and understand the economic theory he discovered. Trust me, Wall Street’s most powerful leaders know his name. And they’ve used his theory to extract massive value from every American.

This chart tells the whole story.

As the government’s debt and deficits increased rapidly during the 1990s, the money supply began to grow. At first this was simply because Treasury bonds are used as bank reserves. As the government’s debts grew, so did the banking system as a whole. More reserves, more lending. More lending, more money supply.

But, following the Global Financial Crisis, the Federal Reserve began to increase the money supply directly by the “monetization” of government bonds. The Fed simply printed whatever amount of money was necessary to finance the government’s enormous new debts. It then bought government bonds with the newly created money. This had the impact of creating trillions in new dollars. At first (2010-2015), these dollars mostly sat unused inside banks. But… eventually… these new reserves became the foundation of still more lending and more credit… and then still more dollars in circulation… and thus, more and more inflation.

And, as you can also see, this newly created money seems to have propelled the fortunes of the top 0.1% of the country in a way that’s tightly correlated. Meanwhile, the bottom 50% of Americans have only seen their fortunes increase slightly in nominal amounts, while there’s been a 10x increase in the money supply.

In real terms, the bottom half has gotten wiped out by inflation.

This is my famous “End of America” hypothesis in one chart. This shows exactly how constantly expanding the money supply (far in excess of increases to production) has vastly enriched asset owners at the expense of wage earners.

This isn’t a flaw in our monetary system or in the governance of our country: it’s a feature.

Richard Cantillon first theorized that whoever gained access to the new money first would profit from all of the inflation that followed. This is the Cantillon Effect. And it explains exactly why elites – in every powerful government – always seek to set up a central bank and thereby control the money supply.

As a French banker in the early 1700s, Cantillon gained access to vast amounts of new credit when economist John Law converted the French economy from the gold standard into a fiat system of money in 1719. Cantillon made a fortune borrowing at fixed interest rates and buying shares of the Mississippi Company. Soon, the shares of the Mississippi Company soared, and thanks to inflation, the value of Cantillon’s debt – in relative terms – disappeared. Converting shares of the Mississippi Company back into gold after only a year, his fortune was assured.

Does that sound familiar? Someone with elite access to information, money, and credit uses his position to borrow a fortune in newly created paper money at fixed interest rates. He then uses that newly printed money to buy real assets that are appreciating, because of the resulting inflation. He’s hailed as a genius.

Michael Saylor should rename his company “CantillonStrategy.”

Follow Saylor’s lead. To protect yourself from the government’s constant expansion of the money supply, make sure you gain access to credit before the resulting inflation takes place. That’s why buying a house, for example, is almost always the best financial decision you can make. You get access to the credit for up to 30 years – in advance. The real value of your loan is inflated away over time. And, assuming you’ve got a low fixed interest rate, you pocket the difference. That’s the Cantillon Effect.

Here’s another powerful example.

During periods of economic weakness, corporate bonds will sell off – sometimes to well below par value, meaning you can purchase a $1,000 face value bond at prices well below $1,000. We’ve recommended discounted corporate bonds trading at prices as low as $700 or even less. The bonds trade cheaply, even when they are “money good” because the company’s earnings decline and the risk of default in these bonds increases.

This distressed debt offers investors one of the purest ways to profit from the Cantillon Effect. That’s because during a recession, the Fed will cut interest rates. The government will stimulate the economy by deficit spending or even by outright money printing. This will trigger the Cantillon Effect.

During a recession, you can lock in five-year money at say 5%. You then buy a group of corporate bonds trading at distressed prices, down like 30% to 40% from face value. They’ll typically be yielding 12% to 15%. You’ll earn positive carry, meaning the yield on the portfolio will be in excess of your interest expense. And when the bonds mature, you’ll earn a big capital gain too. Typical unleveraged total returns on these kinds of portfolios is usually 20% to 30% annually. If you’re leveraging that 3-to-1 or 4-to-1 you can produce 100%+ returns on equity annually.

Oaktree Capital Management is probably the world’s best distressed investment group. They should name the Oaktree in their logo “Cantillon.”

Knowing all of this, look back at the COVID pandemic. That was the best opportunity – ever – to profit from the Cantillon Effect. Long-term credit was available for less than 1% a year and about $10 trillion was printed. Massive fortunes – like Saylor’s – were created through the pandemic. If you took my advice in March 2020 to buy a group of Forever Stocks, you’ve done well. But if you borrowed the money to do it at 1%, you’ve made Michael Saylor money.

Today the prime lending rate in the U.S. is 8%. That makes it difficult to profit from the Cantillon Effect today. But… with the Fed cutting rates… and with Trump promising tariffs… we may yet have another opportunity.

When that opportunity comes, do not miss the opportunities in distressed corporate bonds. You can literally build a fortune with one good corporate default cycle. And as it happens, the world’s premier distressed bond analyst, Marty Fridson, is with us at Porter & Co. If you’re not yet a subscriber to Distressed Investing… you’re missing out on what might be the safest, smartest way to generate enormous returns in the coming months. And as I explain here, now – in the weeks before the inauguration of the new president – is the time to act. Find out more here.

Good investing,

Porter Stansberry,

Stevenson, MD

P.S. Investing in technology is all about getting in front of the next big trend.

There’s no one better at that in the tech world than Jeff Brown.

Jeff is a bona fide prophet when it comes to understanding what’s next in tech.

For example… he got his subscribers into Bitcoin in 2015… Nvidia in 2016… and AMD in 2017.

The results… Bitcoin is up 26,613%... Nvidia, 10,422%... AMD, 1,229%.

In addition to – and connected with – his uncanny ability to tell the future about the direction that technology is moving in, and who will be the winners, Jeff is one of the best stock pickers I’ve ever worked with.

In last week’s Porter & Co. Spotlight, Jeff shared his report on a company he says “could become the market’s next AI darling.”

As always for our Spotlights, this is research that’s typically only available to Jeff Brown’s paying subscribers, but is free for the Porter & Co. family… Check it out here.

And if you want to find out more about Jeff’s research (at a substantial discount to his normal prices) and get his future recommendations, go here now.

Mailbag

Our paid-up subscribers are my secret weapon. Throughout my career I’ve always read every single letter my readers sent – even when I was publishing dozens of advisories at MarketWise, and we’d get more than 100 letters a day. Why? There was always at least one subscriber who knew way more about the topic at hand then even my best analyst. Reading those sources always positioned me to challenge our analytical teams. And the analysts could never figure out how I did it. Please: if you think we got something wrong, don’t hesitate to let us know. We’ll never publish your name without permission. Likewise, we promise to publish every angry letter we receive. We don’t hide our warts. We want to learn from mistakes, and we sure wish the government would try it too!

Nothing in my replies should be construed as investment advice. Always consult with your own advisors about your specific circumstances. Send your letters here: [email protected].

Alan writes:

I remember in the last two years when you were saying that there would be no more Republican presidents. The Liberals were taking control and the American way of life was coming to an end, there was no way Trump would be able to win, yada yada yada, you are merely spreading your conjecture and guess work like so many of these so called investment analysts, blowing hot air, you are not better than the rest of them, although you believe you are stand out legendary figure, above and beyond the others, but you are not, and never have been, you are merely only, a "legend in your own mind" and your imagination is running away with you.

Porter’s comment: I wouldn’t want to be Alan’s cat. Seriously, I think your criticism is a little unkind. Do I have a crystal ball? No. But considering they very nearly assassinated Trump twice, considering they did their very best to put him in prison, I'd like to think that my warnings were certainly worth paying attention to. Likewise, look what they did to our country over the last four years. They kept a mentally-handicapped corrupt President in power and lied about it – right up until the minute they put the candidate they wanted in power. They opened the borders and sent the immigrants to swing states. They printed unprecedented amounts of money and gave it away to their political allies: M1 (cash in circulation) has gone from $4 trillion to $20 trillion under their watch! The value of everyone's wages has fallen by 30% to 40%. I think, taken altogether, that my warnings about Obama’s “third term” weren’t strong enough. As for “my” ability to help investors succeed, my skill is simply in giving a platform to some of the most accomplished and smartest investors in the history of the markets. Look at the immense amount of wealth we helped create through our recommendations. (See the letter below for a sample.) If you don't think that's worth $1,425 per year... then you probably voted for them.

Michael writes (from Canada):

I joined Porter & Co. as a Partner Pass member in December 2023. I am really grateful to have joined as I have enjoyed the research from The Big Secret on Wall Street, Biotech Frontiers, and Distressed Investing. Each research service outlines the investment thesis in such an elegant manner with in-depth analysis. I always read each issue as they come out. I have been fortunate to have joined as Biotech Frontiers started and enjoyed the double 100% in Sagimet Biosciences (SGMT). The performance has been astounding. For Peloton Interactive (PTON), I was also able to lock in a 100% return from that recommendation as my entry price was lower. I have had huge success with all your recommendations over this last year.

My only struggle is purchasing the distressed bonds in Marty Fridson’s recommendation as I have limited broker options in Canada. I use Interactive Brokers, but unfortunately they do not do any convertible bonds, so I have been unable to capture much of the upside in Marty’s portfolio. I am also a Stanberry Alliance member, which is how I discovered Porter & Co. I joined Stansberry Research back in 2022, as I was searching for in-depth analysis to help guide my investing decisions. I wish I knew Pirate Investor back in the day and had joined when you first started, my portfolio would be in a much better position!

Mike writes (from Spain):

Hi, I've been a Stansberry subscriber for many years and a start-up Porter & Co. Partner. I am not a sophisticated market investor, so forgive my somewhat basic questions.

Porter has been forecasting a major recession with an accompanying selloff of the stock markets of 30% or more since my visit to the farm in 2023, almost 14 months ago. As advised, I went to 33% cash in Treasuries, waiting, not buying. Yesterday he re-emphasized the urgency, the severity [as much as 50% sell off] and potential long length of a bear market. This time I identified a number of his recent recommendations in which I am interested. Almost all have had an incredible run up in the last 12 months.

Question 1: Should I buy NOW those that are still at or below his recommended buy price? Is that what he advises when he sets the recommended price? If so, do you normally advise to sell or hold when a selloff occurs? Or, should I buy some now and wait and see if a lower price becomes available? Or should I be patient and wait until the forecast sell-off occurs and then buy? I own $1.3M in preferreds paying 7%. I don't really need the income. Last night Porter advised getting out of fixed income and into distressed bonds.

Question: 2. Do Porter and the industry include preferred stock in the definition of “fixed income" and therefore he recommends selling these and reinvesting in the distressed bonds that he recommends?

Question 3. Does he recommend generally in the coming market to getting out of fixed income [including my preferreds] and holding cash or buying specific equities you recommend?

Porter’s comment: Mike, this is exactly why you should consult with an experienced asset planner if you’re very inexperienced as an investor. There’s no way I can offer you any kind of useful advice about your own asset allocation because I don’t know anything about your situation. I don’t know your age. I don’t know your net worth. I don’t know what your goals are for your wealth – spend it all? Leave a fortune?

Likewise, I’m so sorry, but the way you’ve interpreted my advice is 100% wrong. You’ve done the EXACT OPPOSITE of what I have been suggesting for the last two years. You have 100% of your portfolio in relatively low-yield fixed income (preferred stock) and zero in high quality equity. Meanwhile, I’ve spent the last 15 years of my career explaining how the government is going to destroy the dollar, so you shouldn’t own bonds. Instead, you should own high-quality stocks that can protect and grow your wealth.

I honestly can’t figure out how you looked at our back page and saw 40+ different equity recommendations and ZERO bonds and thought that investing only in fixed income was following our advice. The only bonds we’ve recommended for more than a decade have been distressed bonds, where there’s potential for substantial capital appreciation and much higher than inflation yield. And many of these bonds have been convertible too, meaning that they are also a pathway into equity.

I urge you to read my Permanent Portfolio research and think about a neutral allocation being 25% in stocks, 25% in bonds, 25% in gold/Bitcoin, and 25% in cash.

Today, because I believe the bond market is uninvestable, I’ve suggested an alternative way of investing in bonds that I believe will offer significant outperformance over buying bonds directly. I also think it’s very important to have a full gold/bitcoin allocation and a full cash allocation. The stock market is trading at all-time high levels relative to earnings. There could be a 30%+ bear market at any time. When that happens, you’ll be glad to have cash that you can then invest into great businesses.

I hope this helps. I am grateful for your support and I hope you will consult with someone who can help get you on the right track.