- Porter's Daily Journal

- Posts

- Powell Gets Punched in the Mouth

Powell Gets Punched in the Mouth

Porter's Journal Issue #22, Volume #1

How I Know Inflation Isn’t Dead… and What’s Next

Table of Contents

Three Things You Need To Know Now:

1. An October Surprise, data version. With the U.S. presidential election just eight days away, investors will be watching this week’s economic and market data closely… the Conference Board releases the latest Consumer Confidence Index level on Tuesday, the Bureau of Labor Statistics (“BLS”) reports on its Job Openings and Labor Turnover Survey on Wednesday, the Bureau of Economic Analysis unveils the Q3 GDP number on Thursday, and the BLS announces its Employment Situation Summary on Friday. One big wild card on the employment numbers is the impact of Hurricanes Helene and Milton, which (temporarily) put many people out of work in Florida and nearby U.S. states. Also, around 20% of S&P 500 companies are reporting earnings this week. It’s hard to know how this steady stream of financial data will play out in the markets or in the election, but the numbers will no doubt be spun beyond recognition by both the Harris and Trump campaigns – and more importantly, will set the stage for the next Federal Reserve decision on interest rates, which takes place on November 7. Right now markets say there is a 97% chance of a 25 basis point cut… given that inflation is far from tamed (more on that below) cutting rates again will further deepen the terrifying parallels between today’s inflation environment, and that of the 1970s.

2. Desperate times call for desperate measures at Boeing. This morning, Boeing (BA) announced that it has issued 90 million new shares at around $155 each (down 40% year to date), plus another $5 billion from a convertible bond offering, to raise $19 billion in desperately needed cash. With $57 billion in debt, and teetering on the edge of a credit rating downgrade to “junk” status, this highly dilutive equity offering at a depressed share price was Boeing’s least-bad option to shore up its finances. Even with this infusion of new capital, the plane maker’s troubles are far from over. An ongoing labor strike is costing the company an estimated $100 million per day. Boeing has $26 billion in debt due over the next five years alone, and shows no signs of returning the business to positive cash flows any time soon. And it can’t keep raising new equity at an ever-lower share price for much longer. Thus, absent a miracle turnaround in its business, it’s likely a matter of time before the company will require a rescue from Uncle Sam.

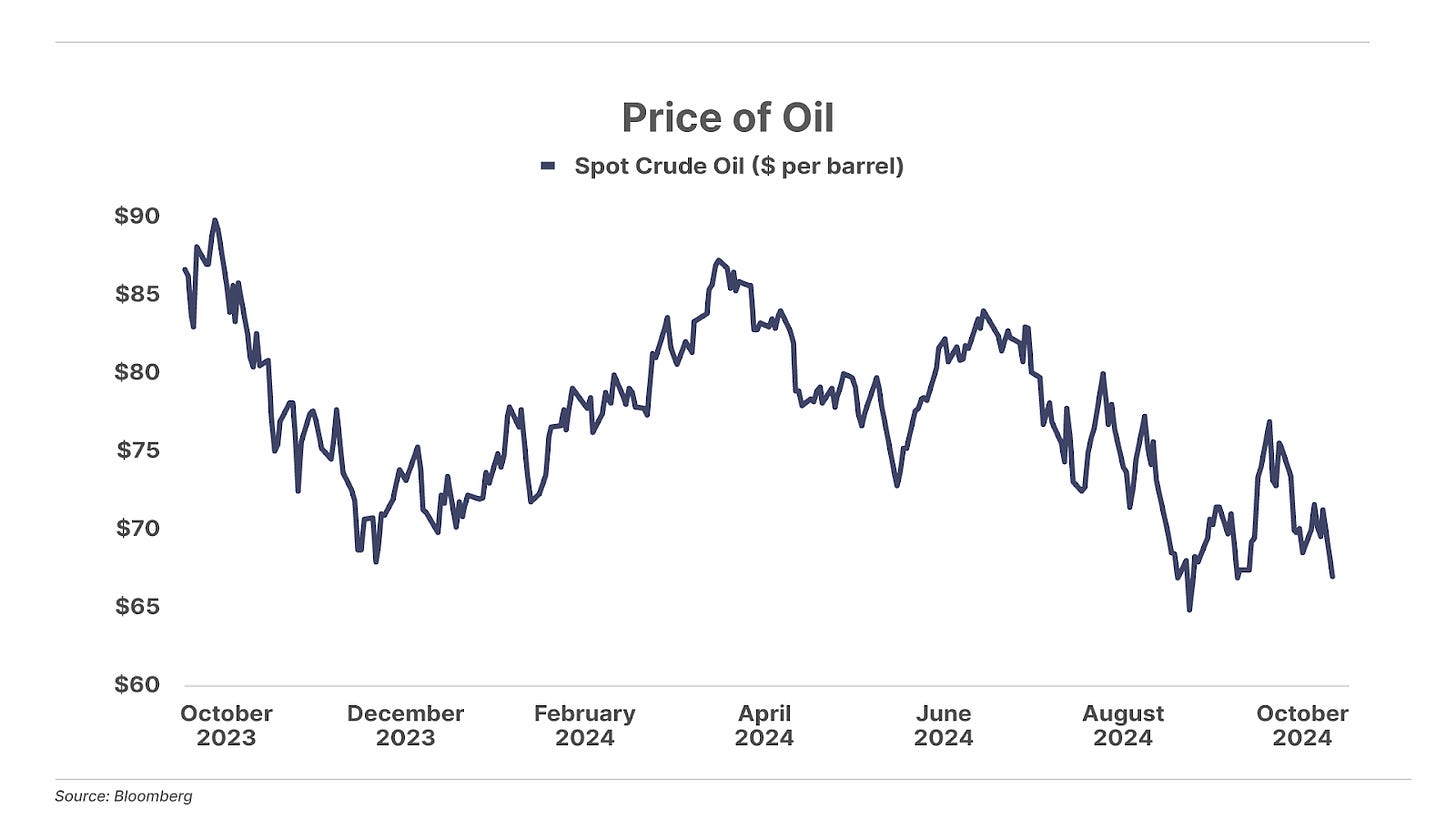

3. Oil prices fall as geopolitical risks fade (for now). The price of oil dropped 6%, to $68 per barrel, today as it became clear that Israel’s retaliatory strike against Iran has (so far) not led to a wider escalation of the war in that region. As we’ve written previously, absent any major geopolitical disruptions in oil production, prices will likely remain lower, as global supply overwhelms demand. The ongoing production boom in the Permian Basin, America’s largest oil field, continues boosting U.S. output to record levels. The U.S. is currently producing 13.5 million barrels of oil per day (15% of global production), and has been the world’s biggest oil producer for the last six years. Meanwhile, cracks are forming within the OPEC+ cartel. The Wall Street Journal reported on October 2 that the Saudi oil minister has issued a “veiled threat” to its member nations, warning of a price war if the cartel members fail to stick to the limits in their agreed-upon production quotas.

And one more thing…

And also… sign of a top: The New York Stock Exchange (“NYSE”) announced that it’s asking the U.S. Securities and Exchange Commission for permission to extend trading on its Arca all-electronic platform from 16 hours a day to 22 hours a day, Monday through Friday. Right now the core trading hours are 9:30 am ET until 4 pm, with pre-market trading starting at 4 am and an after-market session lasting until 8 pm. With the proposed changes, electronic trading would be open from 1:30 am until 11:30 pm. Other platforms allow for round-the-clock trading, and this is one way for the NYSE to try to keep up. Volume is significantly lower in trading outside of the core hours (resulting in, for example, wider bid/ask spreads), as most after-hours trading is done by retail investors and by investors who live outside the U.S. The market capitalization of U.S. companies makes up 61% of the global market cap for all stocks – which is an all-time high. And, as we wrote recently, U.S. stock market capitalization as a percentage of GDP is similarly at an all-time high. If there’s anything that signals a top, it’s the NYSE catering to small investors by keeping the casino running nearly 24 hours a day.

In Case You Missed It:

Last week in The Big Secret on Wall Street we recommended a “hidden gem” capital efficient insurance company that covers everything from workers’ compensation to terrorist attacks, with the potential to return 30% per year over the next decade. It’s one of the most profitable specialty insurers in the industry – and right now, it’s dirt cheap: trading for just over 7x earnings. That’s well below the valuation of some of its peers, which trade at multiples of 25x-30x.

Martin Fridson published his latest Distressed Investing update, where he dug into the recent performance of his bond portfolio, revealed his current top three “Best Buys”... and warned that averages can be deceiving when looking at distressed debt. Marty’s reported that the Distressed Index, which tracks all bonds whose yields are 10 percentage points or more above the yields on default-risk-free U.S. Treasury bonds, has racked up a 22.7% total return in just under five months… more than double the 10.2% total return for the S&P 500 Index over the same period. But there’s a catch: You have to be extremely selective about which bonds you buy.

Marty also wrote a special guest issue of the Daily Journal last week, where he shared secrets from his days in bond research at Salomon Brothers in the investment bank’s 1980s heyday… he explains how to play liar’s poker, and how it compares to trading in bonds.

If you’d like to learn more about subscribing to The Big Secret on Wall Street, or Distressed Investing please call Lance James, our Director of Customer Care, at 888-610-8895 or internationally at +1 443-815-4447.

Powell Gets Punched in the Mouth

“Everyone has a plan until they get punched in the mouth,” boxer Mike Tyson said.

Federal Reserve Chair Jerome Powell is getting a fist in the kisser right now, as the bond market hits back against the Fed’s plans to lower borrowing costs.

On September 18, the Federal Open Market Committee (“FOMC”) cut overnight interest rates by 50 basis points. In normal environments – when the Fed is in sync with the market – long-term borrowing costs follow the path carved out by the Fed.

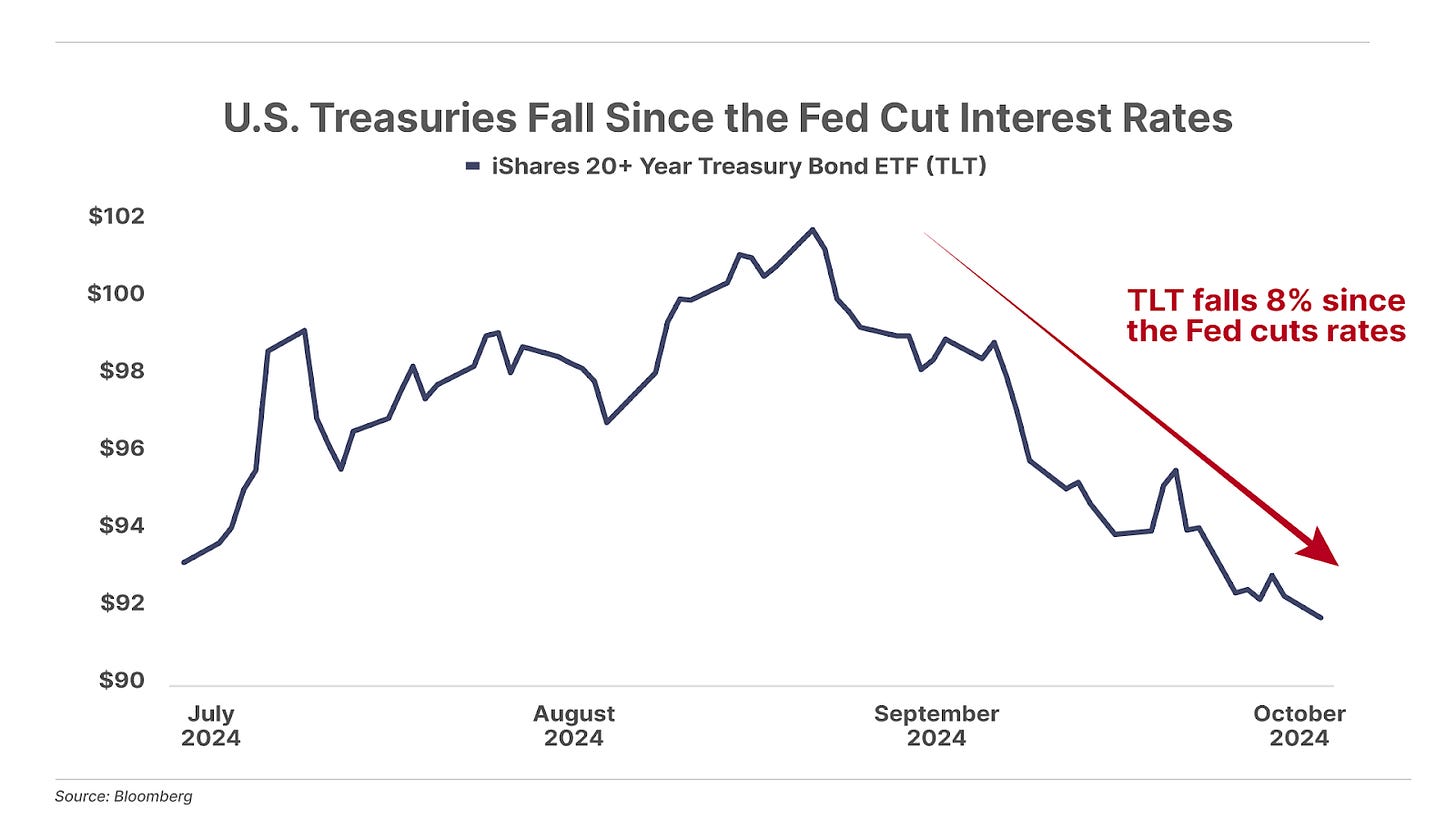

But when the Fed does the wrong thing – say, it cuts rates right before a presidential election, and when inflation is still running hot – something else altogether happens. Since the Fed’s cut, long duration bonds like the 10-year U.S. Treasuries have run screaming in the opposite direction – rising by around 50 basis points. TLT, the 20-year Treasury bond ETF, has fallen 8% since then… an enormous move that is precisely the opposite of what the Fed was trying to engineer.

We’ve seen this movie before, and – spoiler alert – it doesn’t end well.

In 1971, inflation was running at over 4%, but President Tricky Dick Nixon, anticipating presidential elections the following year, wanted some Fed help with an economy-spurring rate cut. “Just kick ’em in the rump a little,” Nixon urged Fed Chair Arthur Burns, according to tapes of conversations that Nixon recorded in the Oval Office about interest rates (other taped discussions would prove even more damaging to Nixon’s political legacy).

Burns, a Republican loyalist, obeyed. Nixon was re-elected in a landslide… mission accomplished.

But the U.S. economy didn’t fare quite as well. By cutting rates too early, price pressures became entrenched in the U.S. economy. American workers, fearful of continued price increases cutting into their wages, began demanding ever-higher pay increases.

That triggered a self-reinforcing wage-price spiral that unleashed a decade of double-digit inflation, crippling interest rates, and stagnant economic growth: a toxic brew known as “stagflation.” It wasn’t until Paul Volcker’s Fed boosted overnight rates to 20% that inflation, reaching a peak of 14.6%, finally receded.

In the interim, U.S. stock and bond investors suffered a lost decade of negative inflation-adjusted returns. The S&P 500 Index ended 1979 at the same price level as 1968… which, after accounting for inflation of around 50% over the period, meant that stock investors lost half of their money in inflation-adjusted (real) terms.

Bond investors didn’t do much better, with the 10-year Treasury logging losses of 3% per year after adjusting for inflation, or a roughly 30% loss in purchasing power over the decade.

Today, Jerome Powell is repeating the fatal mistakes of the Arthur Burns Fed, by cutting short-term rates before inflation is under control – and stoking fears of entrenched inflation.

Stocks can often temporarily defy economic gravity during periods of rampant enthusiasm – case in point is today. But bond investors, who haven’t forgotten the 1970s, are now demanding a larger margin of safety, sending borrowing costs shooting on the long end of the curve.

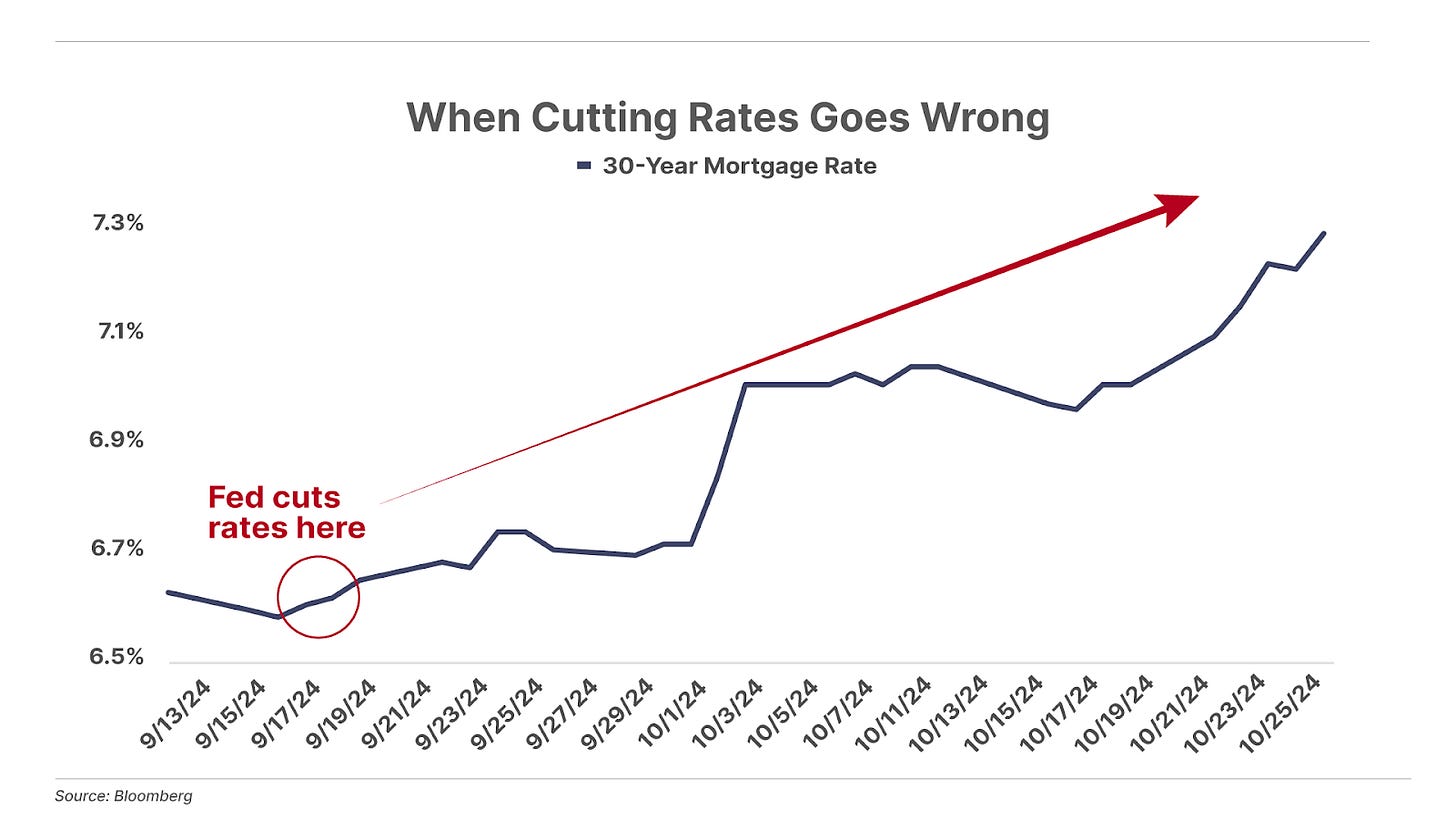

The 10-year U.S. Treasury determines borrowing costs for a wide range of consumer and business loans throughout the global economy. This includes the 30-year U.S. mortgage rate, where yields have been yanked higher in kind with the 10-year Treasury, spiking by around 50 basis points (to 7.21%, according to Bankrate) in the wake of Powell's recent rate cut.

This is a big problem – because, paradoxically, high borrowing costs fuel inflation. That’s particularly true in the housing market, where higher mortgage rates feed directly into a higher cost of home ownership.

The average monthly payment to own the average-priced U.S. home is now $2,215. This means it now requires an annual household income of $106,000 to own the average home in America, up from $59,000 just four years ago.

Unsurprisingly, shelter costs were one of the biggest gainers in the September inflation report, jumping by 4.9% year-on-year and running well ahead of headline inflation at 3.3%.

The Fed hoped to support U.S. economic growth with its rate cut. But that’s backfiring too. Instead of reducing borrowing costs and encouraging more lending, higher long-term rates in the real economy are doing the opposite. New mortgage applications, for example, fell

17% in the latest weekly data. Mortgage refinancings were down a whopping 26%.

Higher borrowing costs aren’t the only factor contributing to sticky inflation. Insurance is another major culprit, where costs are rising across the board at rates well above the rate of headline inflation. And thanks to these and other costs that are continuing to rise sharply – even after stripping out things like volatile food and energy prices – the Fed’s various measures of “core inflation” have been stubbornly stuck above 3% for the last 43 months. And if you analyze the median price in the consumer price index (“CPI”) basket, inflation has remained stubbornly stuck around 4%

Notably, this was the same floor on inflation that the Fed was unable to breach during the 1970s stagflation. History might not rhyme, but it’s sure humming a very similar tune just now.

Americans living in the real world feel the pinch – and are demanding ever-higher wage hikes to offset this cost-of-living crisis. As we wrote above, 32,000 Boeing factory workers went on strike after their demands for a 40% pay raise over four years were rebuffed. The International Longshoremen’s Association is looking for a 62% (!) wage hike over the next six years, to an average of $63 per hour (!!).

With these kinds of pay hikes setting the bar, one thing is clear: Inflation is becoming entrenched into the U.S. economy, fanning the flames of a 1970s-style wage-price spiral. And the 1970s shows us what’s next.

Indeed, consumer inflation expectations are surging to the highest levels of the last 40 years. The Fed won’t be able to keep up its “Mission Accomplished” rate cutting charade for long – when consumers now expect annual inflation rates to exceed 7% over the next five to 10 years.

Only worse… this time, America’s highly indebted economy can’t stomach the 20% interest rates it took to quell the 1970s runaway inflation.

America’s debt to GDP stands at a whopping 120% versus 30% in the 1970s. If the Fed simply kept rates at 5% and forced the U.S. government to finance all of its outstanding debt at that rate, the annual interest bill would soon approach $2 trillion. That’s 40% of what the government collects in tax revenue each year. If rates went to 10%, the federal government would be forced to choose between paying out Social Security and Medicare benefits or funding the military. It couldn’t afford both.

And at 20% borrowing costs, America is officially closed for business. Uncle Sam would be paying more in interest each year than it generates in tax revenue.

And that’s the reason why all roads lead to a prolonged period of runaway inflation. Raising overnight lending rates to control inflation is no longer a viable option given America’s unsustainable debt burden.

The U.S. federal government is barreling toward bankruptcy, and policymakers aren’t willing to even acknowledge, let alone deal with the problem. An honest default and restructuring of America’s debt is simply not a viable alternative for politicians looking to get re-elected. Thus, the only option left is a dishonest default, through inflation.

But don’t take my word for it. Legendary trader Paul Tudor Jones recently said, “All roads lead to inflation. I’m long gold. I’m long Bitcoin. I own zero fixed income. The playbook to get out of this [debt problem] is that you inflate your way out.” Warren Buffett's Berkshire Hathaway (BRK) and Ray Dalio’s Bridgewater Associates are both selling bank stocks as fast as they possibly can.

This past weekend, I was assured by several FinTwit gurus that the problems I've been warning about at Bank of America are a big nothingburger. I heard the same pushback when warning against the impending demise of Fannie Mae, General Motors, and, more recently, Boeing.

These calls didn't require any stroke of brilliance. It was simply a matter of balance sheet math. The same is true about my warnings about today's banking sector. And inflation.

But hope, as they say, isn’t a strategy.

What’s next, and how can you protect yourself, your family, and your assets? If you haven’t already, I urge you to watch this conversation I had with Mises Institute fellow Peter St Onge. I talk about a stock that’s going to do well, regardless of what’s next (or of who wins the upcoming elections)… and a whole lot more.

Good investing,

Porter Stansberry,

Stevenson, MD

Mailbag

As always, let me know what you think, by emailing me directly at [email protected].

In Friday’s Daily Journal, Editorial Director Kim Iskyan shared his own financial survival guide of sorts, titled “What’s Your Plan Z? What to Do When Things Go Bad.” He included scenarios like inflation hitting 50%, or when talk of civil war is more than hypothetical, or when the government comes after your 401(k).

In response, a number of readers shared their own ideas…

J.M. writes:

I have purchased emergency food supplies, ammo, and am visiting the ATM quite often.

Cassandra tells us about a club she is a member of that has a property of about 75 acres at the end of a dirt road:

It has natural springs, a pond with tilapia, solar power, goats, chickens, and guard dogs. Nearby farms have beef cattle. Greenhouses are under construction, and there is a large orchard and vegetable garden. We are all training to use ham radio and get licensed.

I also participate with the local preppers in an urban area. Home gardening, having chickens, as well as plenty of freeze-dried food, water, cooking gear, and water-purification methods.

All my financial records are hard-copy. Keep the car gas tank ¾ full and, if needing to evacuate, leave before the rush.

And D.G writes:

I have done pretty much everything you suggest, except for the second passport. I have two options: my grandfather emigrated from Switzerland in 1860 and I was awarded honorary citizenship by the president of Singapore a few years back. I have offshore resources in Singapore, but do not have a passport or green card. Honorary citizenship gives me all the rights of citizenship except to vote.

B.N. has this to say:

My preparation list is pretty short now. Still need to buy three 160-gallon vertical water tanks and install them inside the basement. After a couple of years of proper rehabilitation, the blackberries, apple, and peach trees, walnut trees, and grape vines all produced this year. Now to see about some small grazing animals. Fencing....ugh.

During WWII, farmers in many parts of France near the warfront continued to live their lives as they had for decades previous. Many locations exist in the U.S. where civil war will most likely have minimal impact.

COVID created a panic to buy rural property. Prices are no longer stratospheric, and property turnover is slow. At least in this part of flyover country. But many properties which were previously idle for years are building residences, barns, and small tractor sales are brisk.

Anyone who didn't start planning and implementation a decade ago is too late.

P.S. It’s your last chance to get Pieter at a Porter & Co.-only low price…

At last month’s Porter & Co. annual conference, at the last minute, I added to the lineup Pieter Slegers, a young Belgian man who writes Compounding Quality. And I’m glad I did.

Pieter focuses on exceptionally high-caliber companies that have big moats and trade at a reasonable price… which, well, is precisely what I do too.

While he’s still a young man, he’s got the insight (and performance) of an investor with decades of experience, and following his ideas could make you a lot of money. Look here to see what he has to say about Nvidia (NVDA). And take a look at this to see his list of companies he’d be prepared to hold for decades.

Pieter is also smart about another topic not enough people know about or appreciate: dividends. Earlier this month, Pieter launched a new service called Compounding Dividends. His objective is to uncover the companies providing a reliable stream of dividend income that are meanwhile growing at attractive rates that will simultaneously compound your capital (an example of what he’ll be doing is here).

Pieter has put together an offer exclusively for Porter & Co. subscribers, for both Compounding Quality (available through this link), and Compounding Dividends (which you can see here). With both offers, you receive a Founding Member package to Compounding Dividends for the price others pay for his basic membership (select the “Annual” option, and then Pieter will manually upgrade you to the full Founding Member level).

And as I said, today’s the last day to take advantage of these opportunities….

… because tomorrow we’re launching a new Porter & Co. Spotlight, on an analyst who’s predicted the biggest technological trends of recent years long before Wall Street, and before any other analyst, caught on to them. And our offers for Compounding Qualityand Compounding Dividends will no longer be available.