- Porter's Daily Journal

- Posts

- Medicine 3.0: Investing in Ways to Live Longer

Medicine 3.0: Investing in Ways to Live Longer

Porter's Journal Issue #23, Volume #1

The Four Horsemen: Fighting Off the Leading Killers

After reviewing “The Three Things You Need to Know Now,” we’re taking a brief break today from our usual investment insights to bring you something special from Porter & Co.’s Biotech Frontiers… about your health. We hope you enjoy it.

Table of Contents

Three Things You Need To Know Now:

1. Q3 GDP is solid… why? The “advance” estimate of third quarter U.S. GDP growth reported this morning, at 2.8%, suggests that the economy continues to hum along – despite many indicators (like a three-year low in job openings, rising consumer credit-card delinquencies, and increasing corporate defaults) suggesting that the economy is in trouble. The figure was below expectations of 3.1%, though... and the “advance” economic growth estimates, which this time is conveniently good news just six days before the U.S. presidential election, are often later revised downward. For example, first quarter GDP “advance” growth was 1.6% – but actual growth, revised later, was 1.3%. Extraordinary increases in government spending, as reflected by the incredible growth of the federal deficit, is also fueling GDP growth – government spending was up 5.0% in the quarter, and on its own contributed to 0.85 percentage points of total growth (compared to 0.66 percentage points for all of 2023). Take on more debt, spend it in the non-productive government sector… and voila, economic growth. How long can it continue?

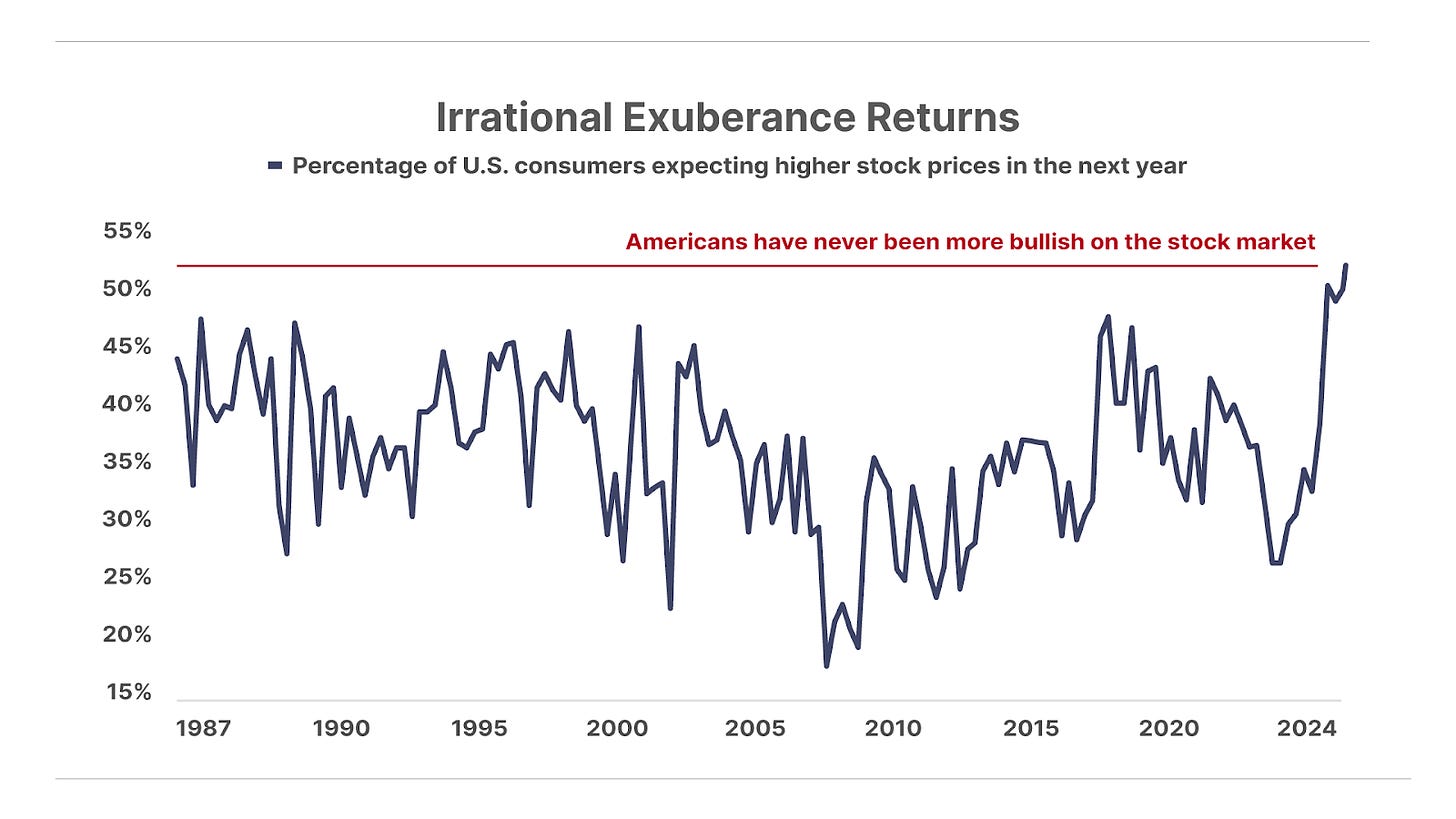

2. Consumer confidence boosted by stock market mania. Yesterday’s report from the Conference Board, a non-profit provider of economic data, showed a jump in consumer confidence to a nine-month high. A key driver of improving consumer sentiment was rampant enthusiasm about further gains in the U.S. stock market, with 51.4% of consumers expecting higher stock prices over the next year, the largest percentage going back to 1987. Meanwhile, American households currently hold 48% of their assets in stocks. This is a sign of optimism… but in reality it’s a warning. This level of exposure by mom-and-pop investors to the stock market was last seen at the peak of the dot-com bubble. That didn’t end well.

3. More cracks forming in the labor market. The latest data from the U.S. Job Openings and Labor Turnover Survey (“JOLTS”) from the Bureau of Labor Statistics showed job openings falling to 7.44 million in September, the lowest level in over three years. The number was a big miss against economists’ forecasts, which called for 8 million job openings last month. Meanwhile, the number of layoffs rose to its highest level since January 2023. One metric the Federal Reserve follows closely from JOLTS is the number of job vacancies per unemployed worker, viewed as a key measure of the slack in the labor market. The latest data puts this figure at 1.1 job vacancies per unemployed worker, the lowest level since 2019 (a lower number indicates a weaker labor market). At the peak of the COVID-era labor shortages, this number was as high as 2.0. The combination of falling job openings and rising layoffs indicates a significant deterioration in the labor market, and presents a warning sign about the future path of the economy.

And one more thing…

Chinese billionaires are disappearing. Due to a toxic combination of economic weakness, a collapse in equity and real estate markets, and ongoing government crackdowns on entrepreneurs, the number of Chinese billionaires has plummeted over the past few years. The total number of Chinese billionaires has fallen 36% from an all-time high of 1,185 in 2021 to just 753 today. Meanwhile, the number of U.S. billionaires has risen nearly 12% over the same period, from 719 in 2021 to 804 today. China’s wealthiest man is currently Zhang Yiming – founder of ByteDance, the owner of the popular short-video platform TikTok – with a net worth of just over $49 billion. Zhang’s fortune pales compared to the wealthiest American – Tesla CEO Elon Musk – with an estimated net worth of over $200 billion. In fact, the two wealthiest Americans – Musk and Amazon founder Jeff Bezos – are currently worth more than the 10 wealthiest Chinese billionaires combined. Perhaps with a bit more government stimulus, China’s billionaires count could recover… It’s done wonders for America’s.

Medicine 3.0: Investing in Ways to Live Longer

Today we’re bringing you something special from Biotech Frontiers analyst Erez Kalir.

In a typical issue, Erez focuses on the exciting arena of biotech, and specific investment opportunities that can deliver life-changing wealth. He’s recommended the shares of a company that sorts through discarded pharmaceutical patents to find drug ideas on the cusp of huge commercial success… introduced readers to cutting-edge cancer research that will save lives and generate billions of dollars in shareholder wealth…and uncovered one company’s jewel-in-the-crown treatment for a skin disorder. Many of Erez’s recommendations are for companies that are focused on eradicating some of the most pernicious diseases affecting people today.

In April, though, Erez put on hold his focus on investing in the biotech sector – to instead address how we can avoid needing to use the life-saving medicines in the first place. We’re extracting from and adapting that issue below. It’s possibly the most important thing you’ll read today – this year – about preserving your health and extending your lifespan.

If Warren Buffett were to grow his net worth by his average rate of return of 20% in 2024, his 94th year of life, this would translate into a $27 billion gain… a one-year haul equal to what his entire lifetime’s net worth was at age 67… The lesson here: the longer you live, the greater your wealth compounds. It’s a staggering statistic that stresses the importance of longevity.

In this issue of The Daily Journal, we’ll explore the theme of longevity. The lens we’ll use is Dr. Peter Attia’s magnificent book Outlive: The Science & Art of Longevity.

To extend our life span and the quality of how we live those added years, Dr. Attia says we need to shift our mindset as patients and embrace a different mindset called Medicine 3.0.

Medicine 1.0 was practiced by the first very doctors starting over 2,000 years ago, exemplified by the Greek physician Hippocrates. The big idea it contributed was that diseases result from natural causes, not the actions of the gods.

Medicine 2.0 dates to the mid-19th century – and the idea that many diseases are caused by germs. Medicine 2.0 has given us an arsenal of drugs that have nearly doubled lifespans since the 1800s, largely by eliminating human mortality from infectious diseases such as polio, smallpox, and, more recently, HIV.

Now we focus on Medicine 3.0… Medicine 3.0 emphasizes prevention more than treatment. It targets the root causes of disease before they become symptomatic in the form of illness, or, more important, before they reach the point of life-threatening emergency.

Medicine 3.0 helps us better understand what Attia calls the Four Horsemen, the four major life-threatening diseases – heart disease, cancer, neurodegenerative disease (e.g., Alzheimer’s), and Type 2 diabetes and metabolic dysfunction.

Horseman #1: Heart Disease

Heart disease is the leading cause of mortality in the United States, accounting for about 29% of all deaths annually. But heart disease is also the most preventable of the Four Horsemen. As Dr. Attia writes, heart disease should be the 10th leading cause of death, not the first.

Why? First, Because, Attia says, mainstream medicine focuses on the wrong warning signs. I would wager that many readers have had their cholesterol levels tested and some of you have been warned that your “bad cholesterol” level – the LDL-C – is elevated. But as Attia argues convincingly in Outlive, LDL-C isn’t a good predictor of heart disease. We need to focus instead on the two specific types of lipid particles that are the most telling warning signs of future atherosclerosis (the clogging of our arteries that directly causes heart attacks and strokes): apolipoprotein B (“apoB”) and Lp(a) (pronounced “el-pee-little-A”). Both apoB and Lp(a) are measurable via readily available and affordable blood panels, but most mainstream physicians don’t test for them. So the first step we need to take as Medicine 3.0 patients is to ask that we be tested for them in our next cholesterol screening.

The good news is that while mainstream medicine may not have the right approach to managing heart-disease risk, it does have many of the right tools – which we can deploy with a Medicine 3.0 mindset. A CT angiogram is an imaging test (shown above) that can provide an informative baseline of whether our coronary arteries are damaged, as well as a quantitative measure of that damage via a calcium score. If a CT angiogram reveals that we are at risk, or if our blood panels for apoB and Lp(a) raise flags, mainstream medicine offers an armory of treatments to reduce the most dangerous lipids that clog our coronary arteries – including statins, PCSK9 inhibitors, and others.

Horseman #2: Cancer

One in five Americans will have received some sort of cancer diagnosis by age 72. But whereas advances in medicine have enabled us to reduce mortality from heart disease by two-thirds since the middle of the 20th century, cancer still kills Americans at almost the same rate it did 75 years ago – we still have a long way to go.

Mainstream medicine today faces two interrelated obstacles in helping cancer patients. First, the armory of medicines we have to treat cancer is limited. And the second problem is that we detect most cancer too late. The five-year survival rate for stage I breast cancer is 99%, for stage I colon cancer, 96.6%. Unfortunately, only about 42% of cancer cases are diagnosed at stage I or II. Put bluntly, the 58% of patients who receive their cancer diagnosis at stage III or IV are in the “too late” bucket.

Physicians and scientists are hard at work on next-generation therapies that promise to expand our armory against cancer. I am especially excited about the promise of an emerging area in cancer immunotherapy, antibody drug conjugates (“ADC”).

If chemotherapy is akin to carpet bombing, ADCs are like precision-guided cruise missiles, able to find their way to specific cancer cells and deliver a toxic payload while leaving the surrounding areas largely unscathed. Several relatively small public biotech companies focus on ADC development, and perhaps we’ll dedicate an issue of Biotech Frontiers to this category of cancer therapeutics.

But getting next-generation therapies all the way from the lab through to regulatory approval and into the cancer clinic is an excruciatingly long, painstaking journey, which can take years and even decades. Fortunately, we do have available – right now – two early-detection modalities for cancer that I believe are game changers.

The first is whole-body magnetic resonance imaging (“MRI”). The leader in this domain is a private company called Prenuvo.

Prenuvo has designed a customized, cutting-edge MRI machine that enables it to complete a whole-body MRI in less than an hour – something that would take most standard hospital MRI machines over six hours. For about $2,500, and with no prescription or referral required, you can book a one-hour Prenuvo scan that detects over 95% of solid-tumor cancers at stage I or before. The scan is also able to detect a host of other serious health problems, including aneurysms, metabolic disorders such as fatty liver disease, spinal degeneration, and some auto-immune disorders (such as multiple sclerosis).

(Full disclosure: I am a very small investor in Prenuvo’s Series A financing, an investment I made after becoming a repeat Prenuvo patient for several years.)

(Editor’s note… during the Porter & Co. Conference last month, one participant told Erez that after he read this original issue of Biotech Frontiers, he got a Prenuvo whole-body MRI – and it discovered a malignant stage 2 tumor on his kidney. If not for Prenuvo, the tumor would very likely not have presented until stage 4 – at which point it may well have been too late. The scan very well may have saved his life.)

The second important early-detection tool is liquid biopsy technology that relies on cell-free DNA. Here the leader is a biotechnology company called Grail. Grail’s Galleri liquid biopsy test analyzes this cell-free DNA for a biochemical signature that suggests the presence of cancer. Galleri cannot detect every type of cancer, but the 50 types that it does encompass are a broad group. The test costs $949 and entails a simple blood draw.

Horseman #3: Neurodegenerative Disease

The term “neurodegenerative disease” describes a family of illnesses that result from a breakdown of our neurons, the cells that make up our nervous system. The best-known neurodegenerative disease is Alzheimer’s, which afflicts nearly 7 million Americans. Other important neurodegenerative diseases include Lewy body dementia, and Parkinson’s.

Unfortunately, despite tens of billions of dollars that have been poured into developing medicines for this family of illnesses, our armamentarium to treat them is still incredibly limited. In the case of Alzheimer’s specifically, none of the FDA-approved treatments are curative.

One of the most important learnings I take away from Outlive is that Alzheimer’s prevention is well worth every Medicine 3.0 patient’s investment of time. Here in brief are the five pillars of Dr. Attia’s prevention strategy:

Exercise: Exercise promotes glucose homeostasis and the health of our vasculature – both of which, in turn, may mitigate the kind of chronic inflammation that increases neurodegenerative disease risk.

Diet: Attia suggests that following both Mediterranean-style and ketogenic diets may provide distinct benefits for Alzheimer’s prevention. Both diets generally improve our glucose metabolism and help mitigate inflammation.

Sleep: Sleep deserves a much longer, more detailed treatment, which I may well make the focus of an entire future issue of Biotech Frontiers. For now, the key takeaway is that sleep, and especially deep sleep, is when our brain heals itself.

Dental health: A growing body of research says that regular brushing and flossing are potent, low-hanging fruit for Alzheimer’s prevention.

Dry saunas: At least four dry sauna sessions per week, of at least 20 minutes per session, at a temperature of 179 degrees Fahrenheit (82 degrees Celsius) or hotter, may help cut Alzheimer’s risk by as much as 65%.

Horseman #4: Type 2 Diabetes and Metabolic Dysfunction

According to the U.S. Centers for Disease Control, diabetes is only the eighth leading cause of death in the United States, causing about 100,000 deaths annually. Why then does Dr. Attia categorize it as the fourth Horseman? Because diabetes itself, and the metabolic dysfunction that generally precedes it, can dramatically elevate our risk for cardiovascular disease, cancer, and Alzheimer’s.

The good news about the fourth Horseman is that it’s the most treatable of the group. While type 2 diabetes itself doesn’t have a cure, the right, aggressive changes to diet, exercise, and sleep can reverse its symptoms, and hold blood sugar levels at safe levels without medications or even insulin. Attia’s chapter on type 2 diabetes and metabolic dysfunction ends with a wonderfully pithy line: One can think of this complex of disorders as the result of the “overfeeding, undermoving, and undersleeping” that are chronic to much of modern life.

If you haven’t yet had a chance to see them, listen to Erez’s conversation with Porter on asset allocation, and with editorial director Kim Iskyan in this Biotech Frontiers Open Forum. Please share your feedback on either or both at [email protected].

Since he launched Biotech Frontiers in January, the portfolio has returned 28.9%, with all but one of the recommendations in the green, and the top performer up 108%.

To learn more about Biotech Frontiers, or to subscribe, click here or call Lance James, our Director of Customer Care, at 888-610-8895 or internationally at +1 443-815-4447.

Good investing,

Porter Stansberry,

Stevenson, MD

P.S. Bitcoin, AMD, Nvidia.

Getting in early on just one of these companies years ago would forever transform your wealth. But well before these names were on the mainstream’s radar, my friend Jeff Brown recommended each of them.

The results?

Since 2015 – when Jeff recommended it – Bitcoin is up 26,613%.

Nvidia… recommended in 2016, up 10,422%.

And AMD is up 1,229% since 2017.

In addition to being a fantastic stock picker – one of the best I’ve ever worked with – Jeff is an absolute Nostradamus when it comes to anticipating the direction that technology is moving in.

He has a deep, intuitive understanding of new technologies, and an unparalleled ability to pick the winners of these emergent trends.

In yesterday’s Porter & Co. Spotlight, Jeff shared his report on a company he says “could become the market’s next AI darling.”

As always for our Spotlights, this is research that’s typically only available to Jeff Brown’s paying subscribers, but is free for the Porter & Co. family… Check it out here.

And if you want to find out more about Jeff’s research or get his future recommendations, go here now.