- Porter's Daily Journal

- Posts

- Commercial Real Estate Looms As A Massive Market Risk

Commercial Real Estate Looms As A Massive Market Risk

Porter's Journal Issue #42, Volume #1

And Why It’s Worse Than The Subprime-Mortgage Crisis

This is Porter & Co.’s free daily e-letter. Paid-up members can access their subscriber materials, including our latest recommendations and our “3 Best Buys” for our different portfolios, by going here.

Table of Contents

Three Things You Need To Know Now:

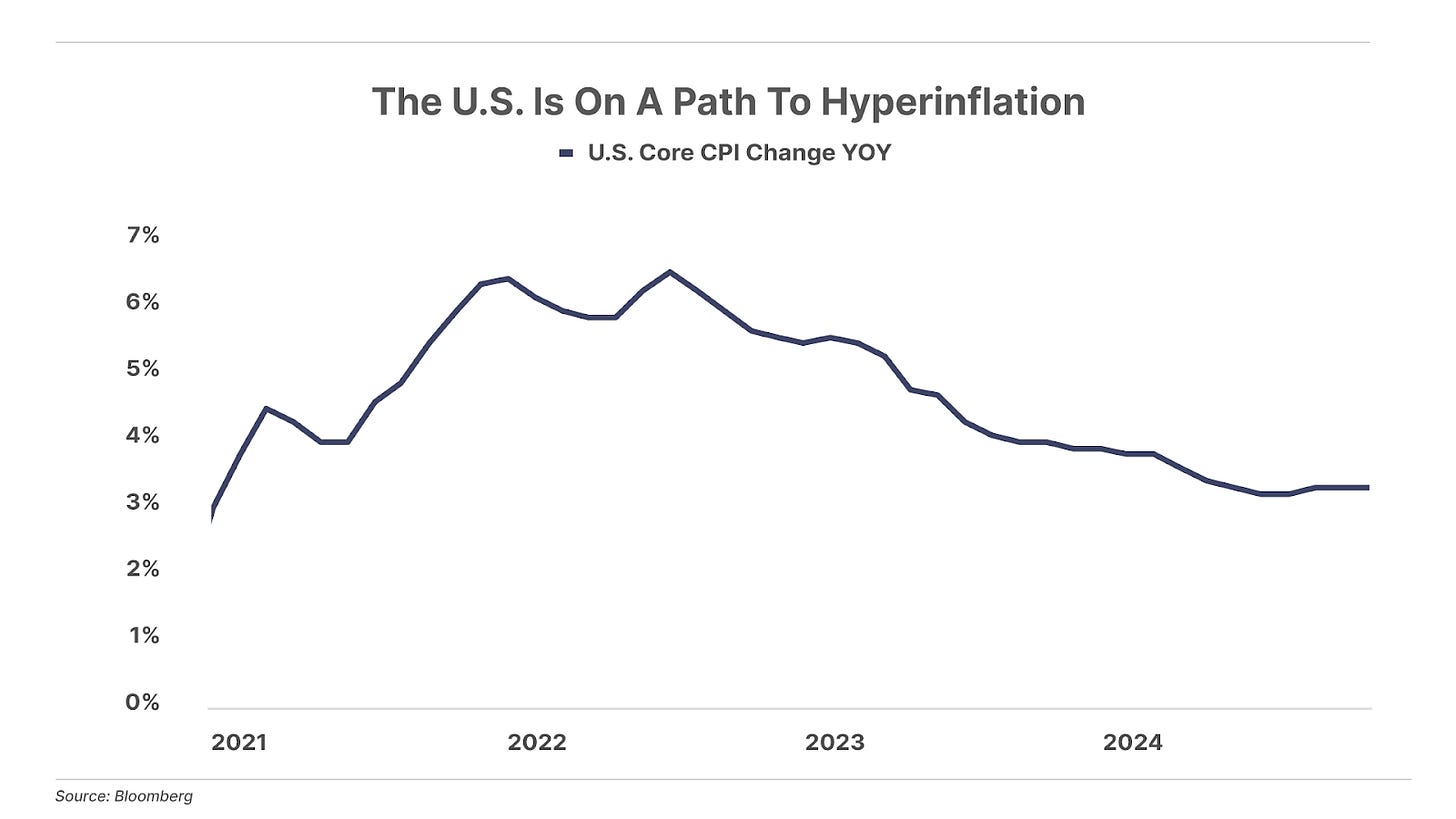

1. This will be the last Fed cut in this cycle. Government deficit spending continues to propel inflation, which hasn’t fallen below 3% despite weak private-sector employment and a 33.5% jump in corporate bankruptcies this year. Deficit spending in the last two months was $624 billion, putting the country on track for a highest-ever $3.5 trillion deficit in 2025. We are on the path to hyperinflation. When asked about the likelihood that President-elect Donald Trump would actually cut government spending, Grok, the AI tool built by Elon Musk, says, “The chances that Trump will significantly reduce U.S. federal spending appear low… While intentions might be there to cut spending, substantial reductions in federal spending are unlikely.”