- Porter's Daily Journal

- Posts

- Buffett Buys Domino’s!

Buffett Buys Domino’s!

Porter's Journal Issue #30, Volume #1

Here’s What Else He Should Buy From Our Portfolio

(Inside: three great investment ideas)

This is Porter & Co.'s free daily e-letter. Paid-up members can access their subscriber materials, including our latest recommendations and our “3 Best Buys” for our different portfolios, by going here.

Table of Contents

Three Things You Need To Know Now:

1. Powell pushes back on further rate cuts. In a speech to business leaders in Dallas yesterday, Federal Reserve Chair Jerome Powell said: “The economy is not sending any signals that we need to be in a hurry to lower rates.” He added: “The strength we are currently seeing in the economy gives us the ability to approach our decisions carefully.” While Powell didn’t specifically address the likelihood of a cut next month, the futures-market odds of a December cut dropped from 80% to 60% following the speech.

2. The American consumer isn’t tapped out yet. Despite continued rising prices, the U.S. consumer is still spending. This morning, the U.S. Commerce Department reported that retail and food-service sales rose 0.4% month-over-month in October, slightly better than economist expectations of 0.3%. September sales were also revised sharply higher to 0.8% from an initial estimate of 0.4%. Consumption growth – by far the most important (at 68%) component of American GDP – will add doubt over whether the Fed cuts rates. However… where are consumers getting the cash? This kind of spending growth might not be sustainable…

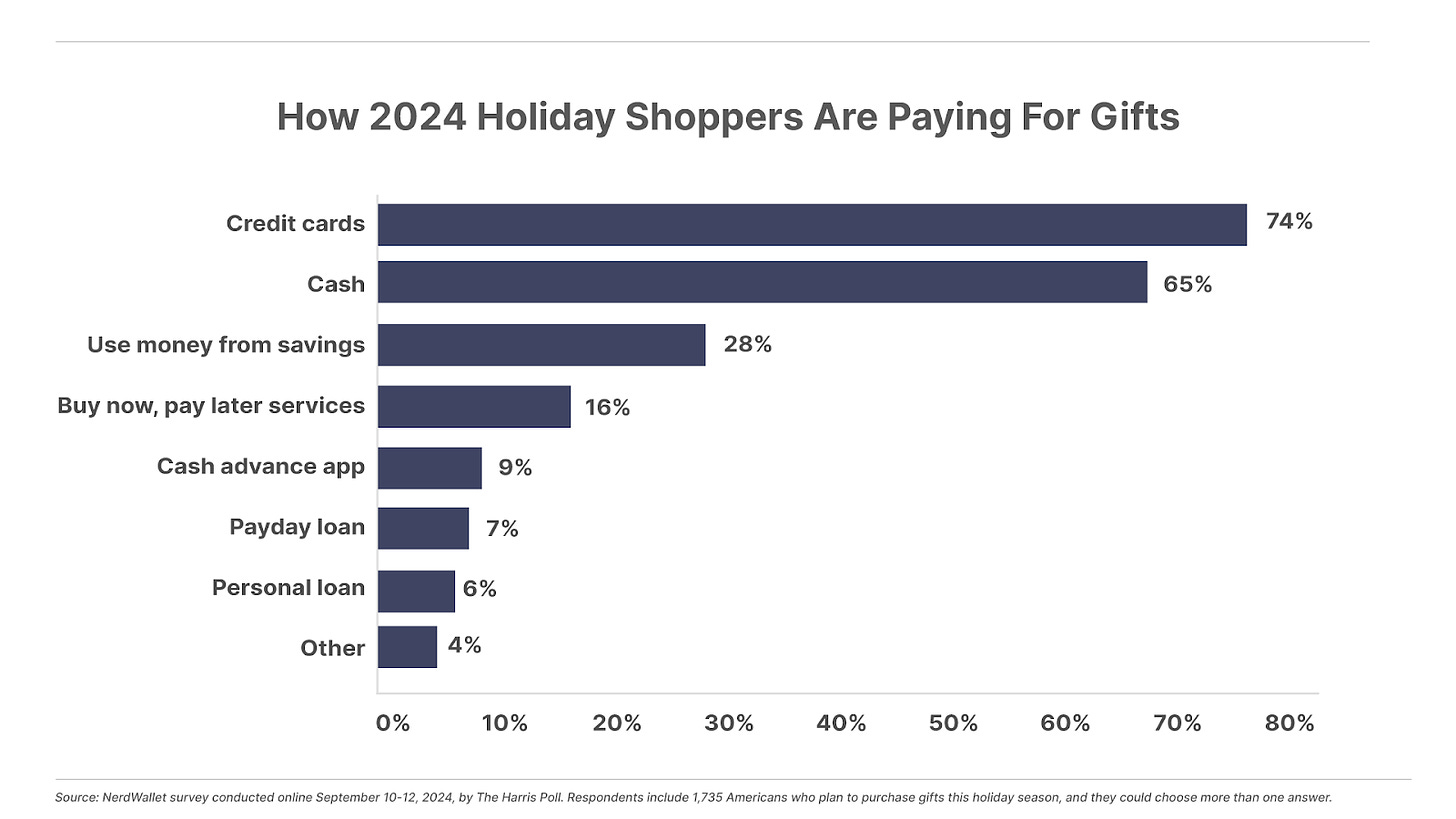

3. Good thing Santa takes plastic. About 28% of U.S. credit card users are still paying off their debt from last holiday season, and nearly three-quarters of holiday buyers will be using credit cards. And the next Christmas is almost here, during which Americans are expected to spend over $200 billion on gifts, up 9.2% from 2023. The average credit card balance is 20% higher than two years ago, and it’s not even Black Friday. That isn’t good news for continued growth in spending: While the U.S. government can seemingly take on more debt with no (short-term) consequences, that’s not the case for consumers, who at some point will hit a ceiling on just how much debt they can take on.

And one more thing…

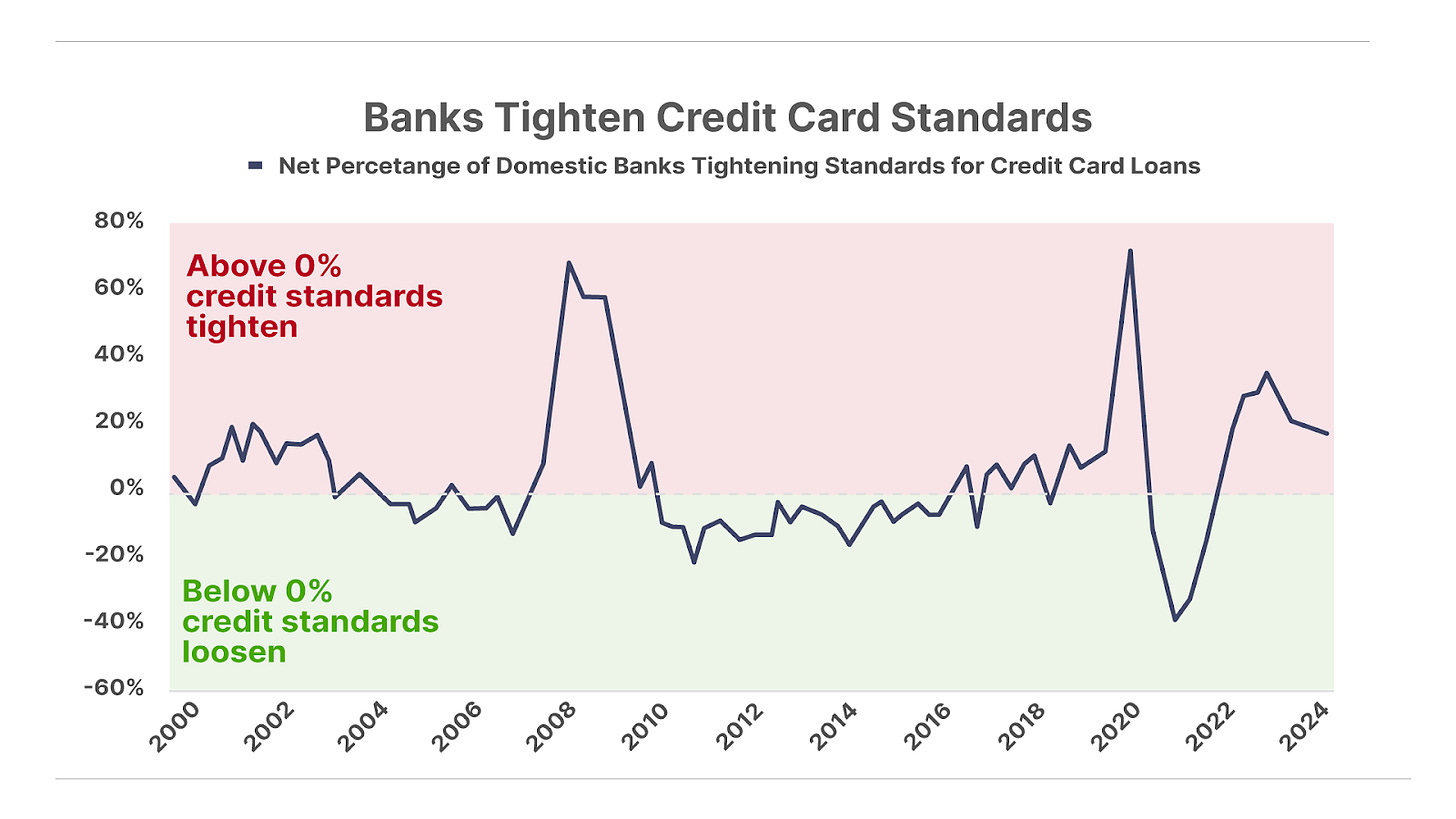

It’s only getting harder for Americans to access credit. Meanwhile, even accessing credit to take on more debt is getting more difficult. Since 2022, banks have tightened credit standards. As the labor market weakens and credit becomes harder to obtain, more consumers are going to be denied credit when they need it the most.

In Case You Missed It:

Our first-ever short recommendation in Thursday’s The Big Secret: This aircraft maker's complex web of mismanagement and regulatory failure has led to two fatal crashes and a potential bankruptcy.

Marty Fridson double-dips in Distressed Investing: In our monthly issue, also released Thursday, Marty Fridson recommends shares associated with a bond that’s risen 27% since he introduced it to readers in July 2023.

And, speaking of Marty, he just logged a 124% win on PTON... After first recommending Peloton Interactive (Nasdaq: PTON) stock on June 14, this past Monday he alerted subscribers to sell half their position at a gain of 124%.

Also this week, Porter sat down with Daniela Cambone of ITM Trading to discuss inflation… gold… Bitcoin… and what to invest in before January 20. Watch it here.

As always, if you’d like to learn more about or subscribe to The Big Secret on Wall Street or Distressed Investing, just call Lance James, our Director of Customer Care, at 888-610-8895 or internationally at +1 443-815-4447.

Today’s Poll: Do You Short?

Yesterday we wrote about the problems at Boeing (which we first addressed in January 2023), and added a short sale of Boeing (BA) shares to The Big Secret on Wall Street portfolio. Though recommendations are normally available only to fully paid-up subscribers of The Big Secret, we made an exception here because of the importance of highlighting the challenges facing an American icon.

Shorting a stock – that is, betting that the share price will decline – is viewed by many investors as too risky... in part because the downside is theoretically infinite (unlike when you buy a stock – the most you can lose is all you've invested).

Buffett Buys Domino’s! Here’s What Else He Should Buy From Our Portfolio

(Inside: three great investment ideas)

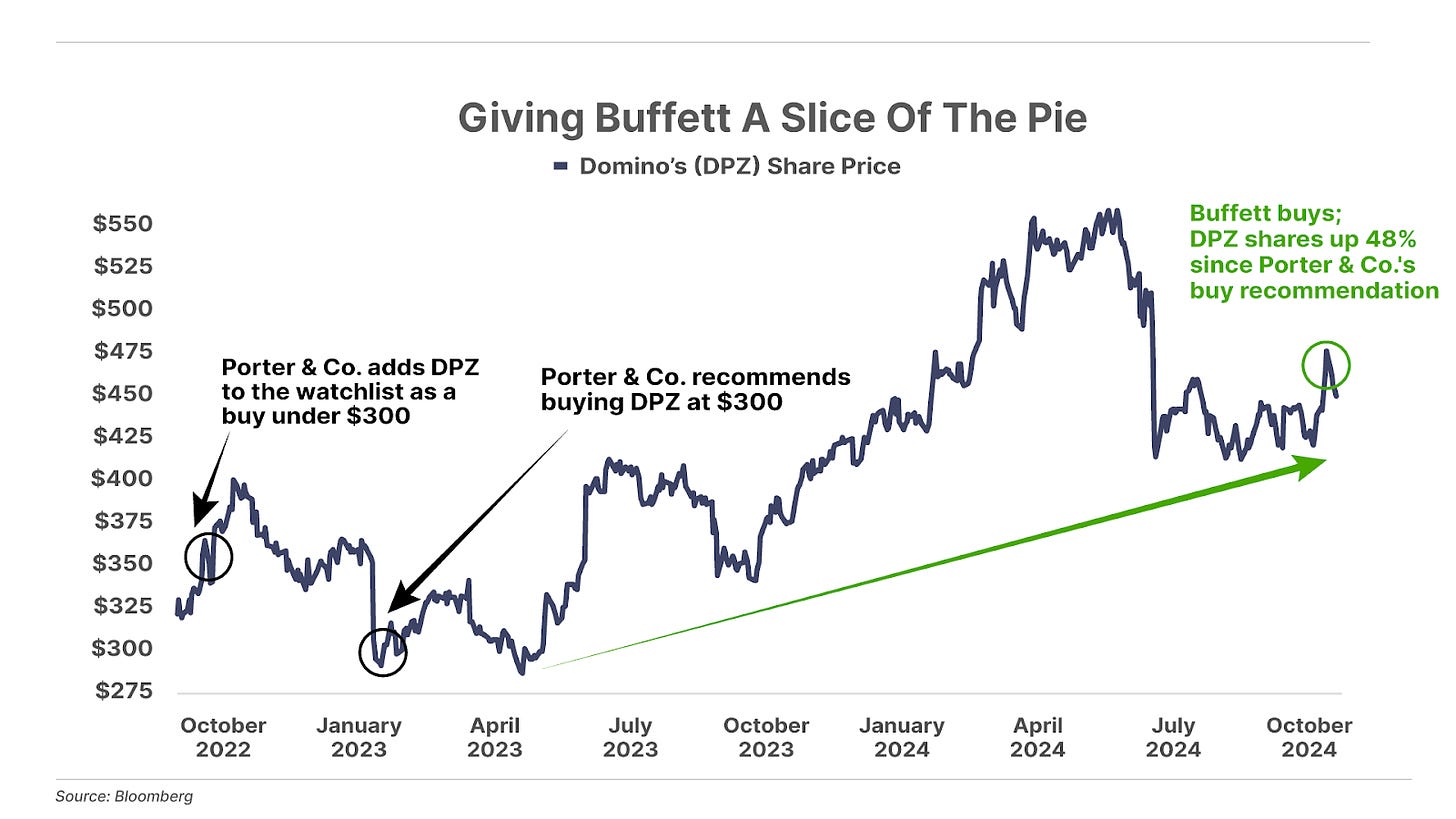

Public filings indicate Berkshire Hathaway (BRK) has acquired a big position (1.28 million shares or nearly 4%) in Domino’s Pizza (NYSE: DPZ).

This endorsement should help one of our long-time recommendations in The Big Secret on Wall Street. Subscribers would have been wise to buy Domino’s below $300 following our recommendation to do so in February 2023. It’s up 48%.

Warren Buffett buying into stocks I have recommended has happened many times in my career – for example, he bought 100% of Alleghany in 2020, right at the bottom of the COVID panic.

The company, a property and casualty insurance firm (P&C), had been one of my favorite investments for a decade.

And there’s something you can learn from this deal: how to value P&C stocks.

Buffett paid $11.6 billion for Alleghany, which, on its face, was a very low price: only 12x projected full-year earnings and only 1.26x the firm’s book value.

As P&C investors all know, these firms have an enormous potential off-balance-sheet asset. If a P&C company’s underwriting is profitable (if it takes in more money in premiums than it ends up having to pay in claims), its annual premiums can become something akin to a never-expiring line of credit. This so-called “float” isn’t technically an asset of the company, which is why you won’t find it as a line item on the balance sheet, but it nevertheless is enormously valuable in the real world, because the company can invest this capital and keep all of the earnings that result.

So, in high-quality P&C insurance companies, the real question is how much you should pay to gain control of this float. Alleghany held $14 billion in float at the time of the deal. Thus, Buffett really bought $14 billion in capital at a discount. And he got the rest of Alleghany for free, including its portfolio businesses, which separately were generating around $350 million a year in profits.

Bottom line: add together Alleghany’s book value and its float and you’ll find that Buffett paid less than 50% for the value of that total capital. That was a heck of a deal.

Note to self: make sure you always know what the combined value of float and book value is for every leading P&C firm that you’d like to own, because when those stocks trade below that price, they are among the best investments you can ever make.

Let me stress this. I am 100% convinced that if you simply limited your entire investment activities to only buying high-quality P&C companies when they’re trading at a discount to float and book value, you would certainly be one of the best investors in the world and you would completely dunk on every hedge fund. This is the real secret to Warren Buffett’s success.

And that’s why we are one of the only firms in the world that calculates every leading insurance firms’ float (it’s an off-balance-sheet asset that isn’t on the Bloomberg terminal) and then, every year, publishes an entire industry-wide analysis of float and book value of every major firm.

You’ll find the premium or the discount to float+book in our P&C Valuation Report, on page 6, column 15, which was updated in September. Paid-up subscribers can click here to read it. And if you’re not yet a subscriber, you can get access to our guidebook to investing in P&C insurance, plus our valuation report, and reports on three of our favorite companies in the sector, for a ridiculously low price… see here.

Let me reiterate how important this is to anyone who wants to build real and lasting wealth with their investing. This is the only kind of investing that I am going to teach my sons, directly. Before they get out of high school, they will know the float+book value of every leading insurance company by heart.

Today, there are two leading companies trading at wide discounts from book+float (-22% and -36%). Discerning subscribers won’t have any trouble figuring out those companies: just look at column 15 and match the discounts. Horse, meet water.

I believe it’s likely that Berkshire will actually buy one of these two firms eventually. Buffett has expressed admiration for the company’s management team publicly before and it routinely trades at a discount to its book+float value, which is something we know Buffett looks for when doing whole-company acquisitions.

So, that is the company Buffett probably will buy… but it’s not the insurance company he should buy. Buffett should buy Progressive (PGR).

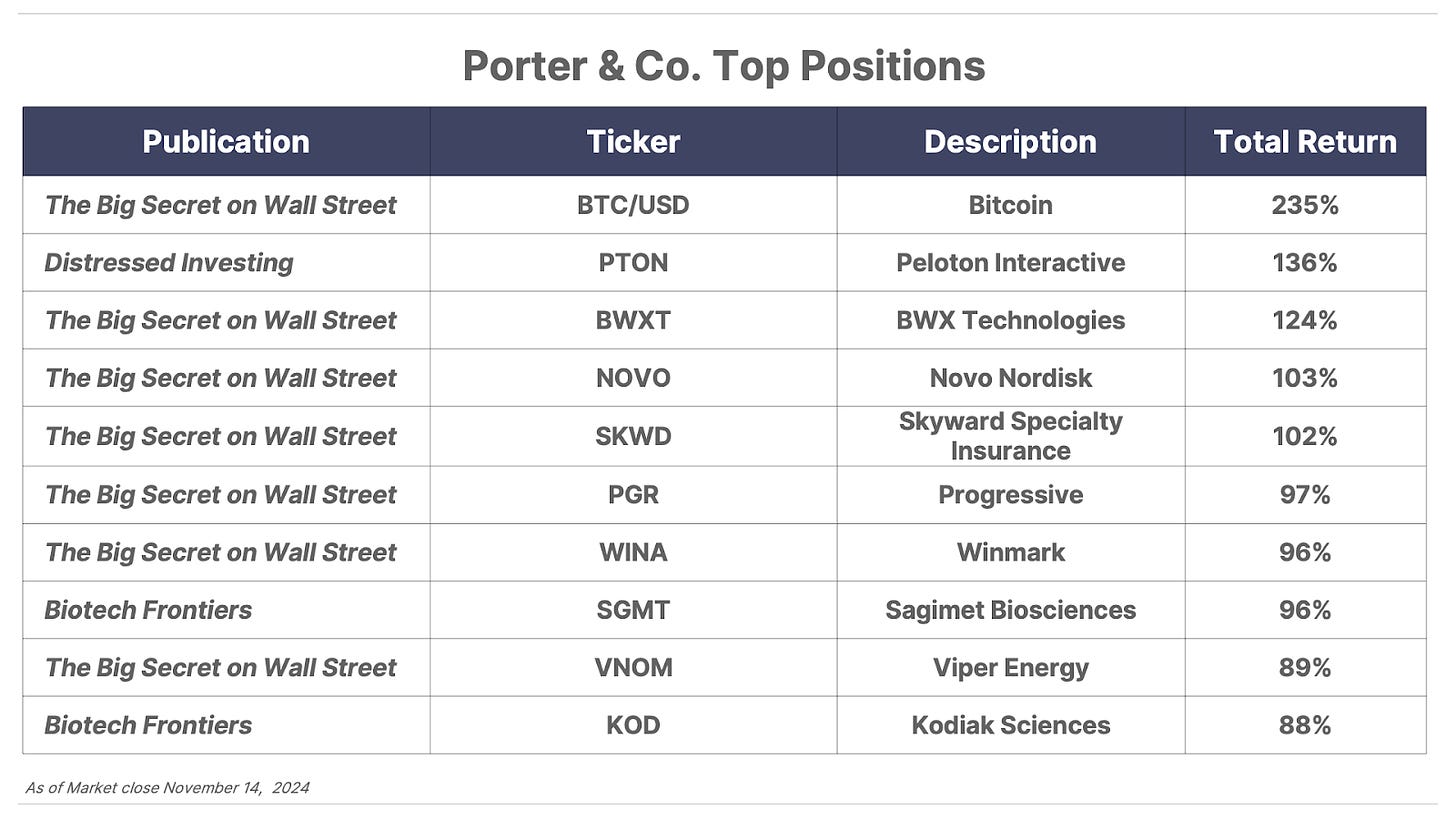

Progressive was one of our two highest-rated stocks when we published our first insurance industry analysis at Porter & Co in the spring of 2023, at the founding of our firm, along with W.R. Berkley (NYSE: WRB), Chubb (NYSE: CB), and Skyward Specialty Insurance (Nasdaq: SKWD). The returns on this portfolio have been astonishing – two of the stocks have doubled and the other two are up more than 50%.

Buffett should buy Progressive because it has soundly beaten his own automotive insurance company, Geico, by investing heavily in technology. This allows Progressive to serve more policyholders with fewer employees and to achieve the best-underwriting results in the industry (loss ratio = 70). This massive advantage explains why Progressive trades at a large premium to its book+float value: it’s worth it.

And one more thing about high-quality P&C stocks. As interest rates rise (don’t look now but the 10-year yield on U.S. Treasury bonds just passed 4.5%), insurance companies, because they actively manage their bond investments, are able to move capital into higher-yielding securities, meaning that they are among the few businesses that typically report higher earnings with rising rates.

What else should Buffett buy from our portfolio? PayPal (Nasdaq: PYPL).

We think Buffett would want to own PayPal because he's owned the world's leading payments brand, American Express (AXP), for decades. As with P&C insurance companies, these firms tap also into the financial equivalent of a perpetual motion machine: free access to other people’s money, which can be invested and compounded in value, before returning it to its rightful owner.

PayPal, the world’s largest digital-payments network, enjoys an even more attractive source of float. When a PayPal user deposits or receives cash into their account, on average, that cash sits idle for nine to 12 months. In the meantime, PayPal can put that cash to work in short-term fixed-income investments. The company currently has $39 billion in customer deposits on its balance sheet, a number that grows larger each year as the payment network and transaction activity grows. And in today’s high interest rate environment, PayPal is earning a record $183 million each quarter in interest income alone.

The best part is, to generate this income requires no incremental overhead or other operating expenses – meaning it becomes pure free cash flow. The company is aggressively returning that cash to shareholders via buybacks, including $5.4 billion in repurchases over the last 12 months, reducing the share count at a pace of 7% annually.

Even though PayPal shares have rallied by more than 40% this year, its valuation remains dirt cheap at just 12x free cash flow. And then there’s this…

While only finance geeks may be familiar with Buffett’s secret sauce – the float he’s able to capitalize on in his insurance and payments companies – everyone knows that Buffett loves branded consumer product companies with exceptionally long-lived franchises. And there’s no other business in the world that fits that bill better than Philip Morris International (NYSE: PM).

Talk about long-lived and profitable: one dollar invested in Philip Morris in 1924 has become $23 million today, a 16% annual return, making it the best performing stock – by far – in the history of the capital markets. In 1970, Philip Morris moved its listing to the New York Stock Exchange and conducted a large share sale. Since then it’s compounded its shareholder’s wealth at a 17% annual pace. If you’d bought then, you’d be up almost 50,000%.

Today, after a long period of declining cigarette sales, Philip Morris revenue and profits are growing again by double digits.

And there are few large-scale businesses that are as profitable: net income margin is 26% and return on total capital is 20%.

With the business now focused on building safe nicotine products (like Zyn nicotine pouches), not tobacco products, it’s more likely that investors who are sensitive to their reputations will begin investing in Philip Morris.

We think the company is in the midst of going through a re-rating – where instead of being valued as a pariah tobacco stock, it will become one of the world’s leading branded growth companies.

Today, at 20x earnings, it’s over-priced as a no-growth cigarette company – but it's cheap as an ultra-high-quality growth business.

Finally…

The biggest mistake Buffett made in his career was refusing to invest in leading technology companies even though he knew them well (Microsoft founder Bill Gates is his best friend) and even though he had many opportunities to buy them at distressed prices (in 1998, in 2002, in 2008, and in 2020).

Just imagine how big Berkshire would be today if Buffett had bought 25% of Microsoft (MSFT) in 2002!

And I want to be clear: I’m not suggesting that Buffett should have bought Microsoft at its IPO. But by the time Buffett met Gates in 1994, Microsoft had been a leading publicly traded software maker for almost a decade. And by the giant tech bear market in 2001-2002, it had been around for more than 20 years.

My point is, you don’t need to be a computer scientist to understand a great business. Just like today, you don’t need to be a tech expert to see that the shift to parallel computing is going to be the most important change in technology in our lifetimes.

And just like Buffett missed the internet and just like he missed the social media revolution, he’s going to miss the biggest change in technology since the abacus was replaced with the integrated circuit.

The difference in computing efficiency and power gains between serial computers (x86 architecture) and parallel computers (led by Nvidia’s chip making) is much larger than the difference between abacus computing and the first calculators.

This isn’t incremental improvement: it’s a complete revolutionary restart of technology.

And, it isn’t new. These changes have been underway for more than a decade.

Please, even if you're never going to read anything from us again, don't miss our presentation about the Final Frontier.

And, if you're already a paid-up subscriber, make sure you read and understand our Parallel Processing Revolution special report.

Good investing,

Porter Stansberry,

Stevenson, MD

P.S. In the haze of the post-election market euphoria, gold is down… 8% from its all-time high of $2,800.80 per ounce on October 30. Investor attention has instead shifted, for now, to the “Trump trade” of stocks, the U.S. dollar, and Bitcoin. But the underlying dynamics of the gold, and the reasons to hold it – as a hedge against inflation, as portfolio insurance, as a store of value, and (it’s up 24% in 2024) simply as a good investment – haven’t changed.

Meanwhile… the shares of gold mining companies have massively underperformed the price of gold. This is partly due to investor distrust of gold miners, who have as a group historically proven to be skilled at wasting capital and overinvesting at the wrong times.

Porter recently sat down with Marin Katusa, a world-leading gold expert, to talk about gold and gold miners. Marin has a fantastic record of picking those mining companies that swim against the tide to take advantage of strong gold prices…and he has thoughts on what’s next. You can hear what Porter and Marin have to say here.